How to manually file a quarterly prepayment in California

by April 12, 2024

Please note: This blog was originally published in 2021. It’s since been updated for accuracy and comprehensiveness.

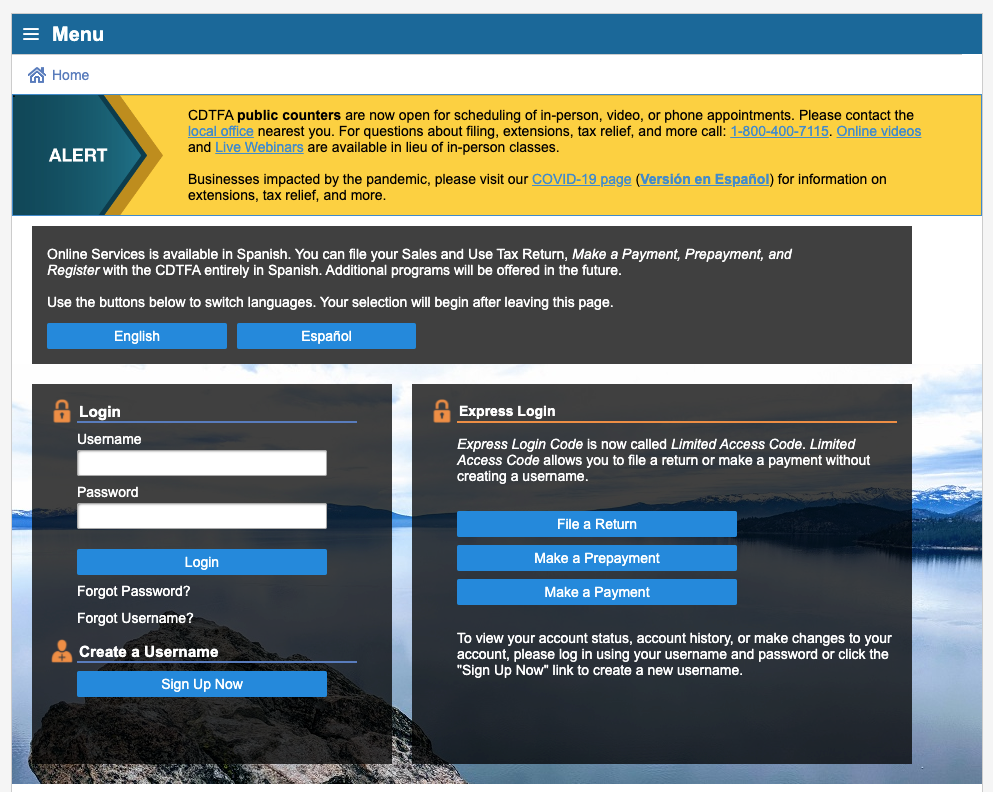

In California, some sellers are required to make Prepayments in between filing their quarterly returns. If you’re in that camp and filing manually, login to the California Department of Tax and Fee Administration website in a separate tab.

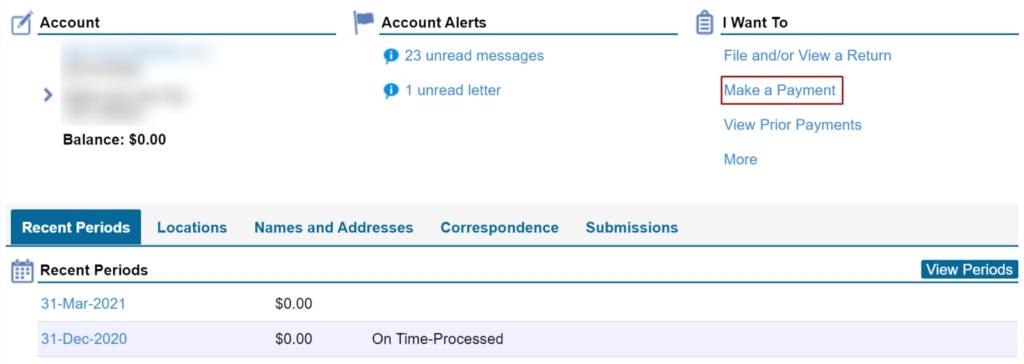

When filing your prepayment, you want to go straight to “Make a Payment” under the “I Want To” menu on the right of the page as indicated below.

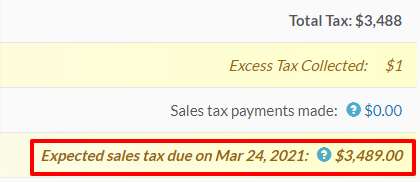

You can find the information you need to file your prepayments under the Expected Tab of your TaxJar California Sales Tax Report. Use the amount under “Expected sales tax due” to make your payment. Do NOT include Excess Tax in your prepayment. Excess will be taken care of when filing your quarterly return.

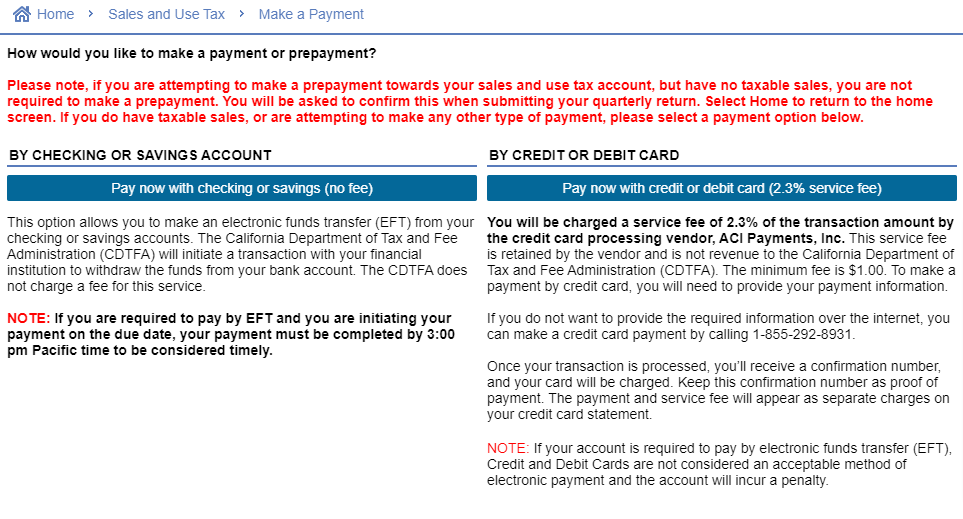

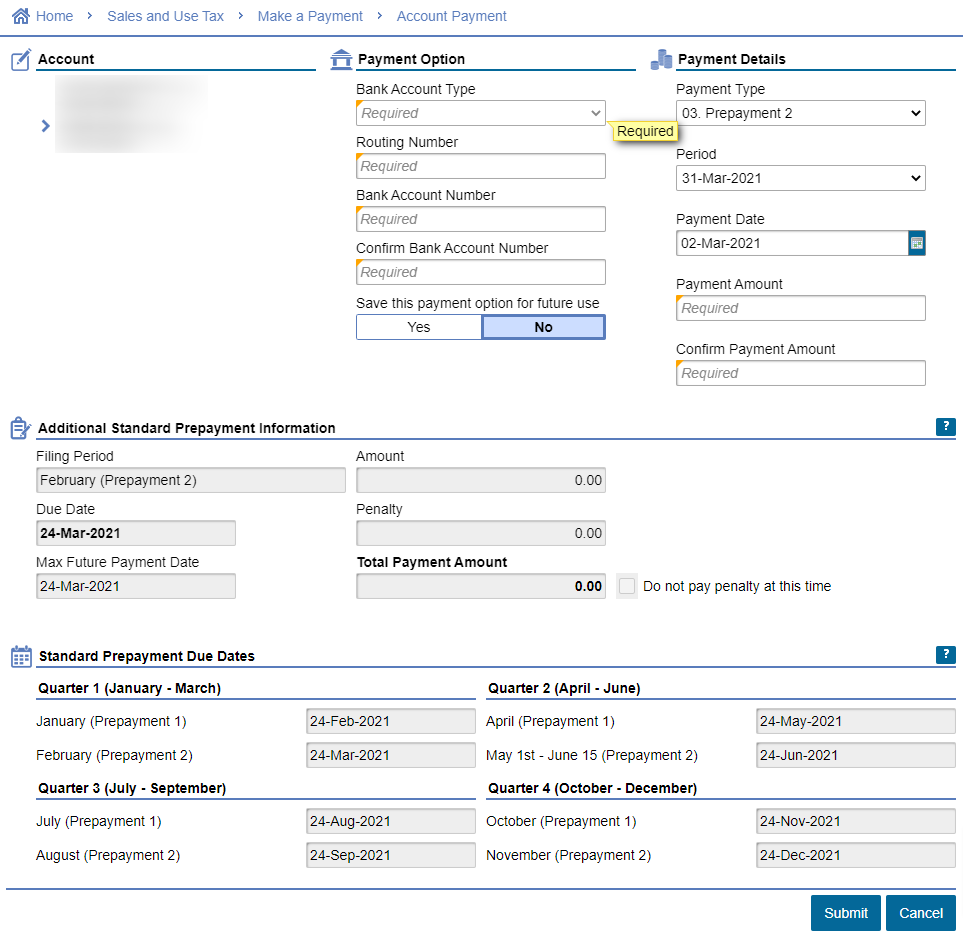

Once on the payment page, input your payment information and be sure to select “Prepayment 1” or “Prepayment 2” depending on which one you are filing. Then select the correct quarter for which you are making the prepayment.

Click “Submit” and save your confirmations and you are done filing your California quarterly prepayment.

Ready to automate sales tax? Sign up for a free trial of TaxJar today.