Three ways to handle increased volume and nexus changes after Cyber Monday

by November 1, 2023

Please note: This blog was originally published in 2020. It’s since been updated for accuracy and comprehensiveness.

You successfully prepared for Cyber Monday and your e-commerce business is thriving. Ideally, your preparation paid off in sales even better than expected. What does this mean for you? In short, it means that while your Cyber Monday preparation and sales might have concluded, you still need to think about what comes next.

1| Determine where you have economic nexus

With the flurry of online sales, there’s a good chance you may be approaching or have surpassed economic nexus in a few new states during Cyber Monday. Why is this so important? You’re going to need to remit taxes in each state where you’ve reached the economic threshold for total revenue or number of transactions. It might not seem like much will change if you added one or two new states to the list, but what if you added 15?

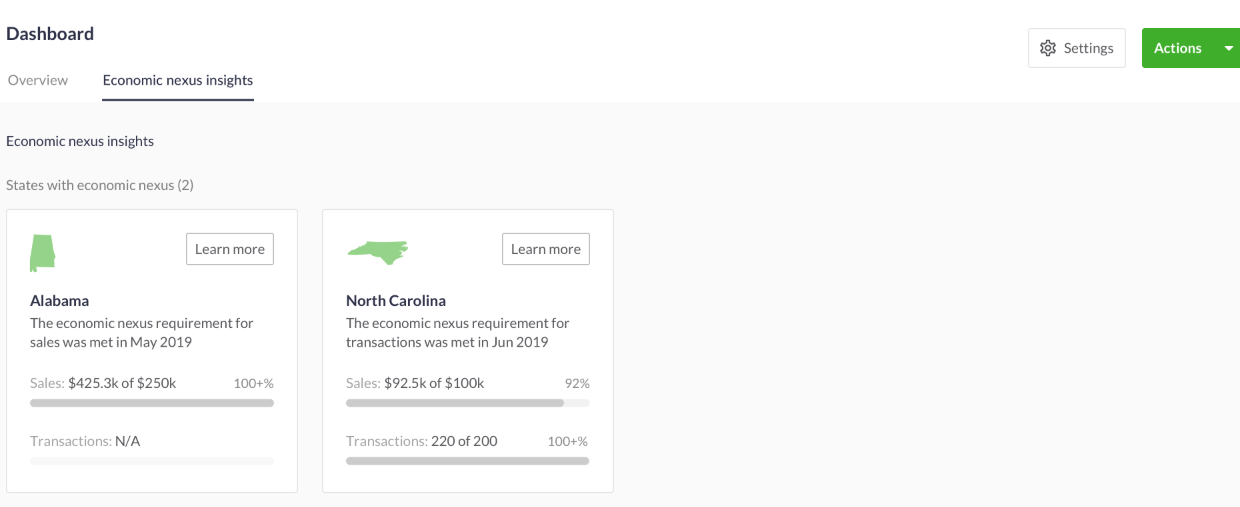

You have a few choices to determine where you now have economic nexus. You can manually go through each state’s economic nexus law and compare with your sales, or you can automate that process with a solution that can instantly check for you and tell you where you have a new sales tax responsibility. TaxJar’s Economic Nexus Insights allows you to simply import your sales data into TaxJar to determine where you’ve reached the threshold in each state.

2| Know where you’re approaching economic nexus in a new state

While you might not have to collect sales tax in some states just yet, you’ll want to know when you’re close to approaching economic nexus and begin thinking about next steps, such as gathering information on how to comply with sales tax in each of those states, how to register for a sales tax permit, and how to start remitting sales tax when the time comes.

Similar to above, you have some choices on how to monitor your progression. You can manually track where your sales and transactions are against each state’s threshold or you can automate the process with an automated solution, like TaxJar.

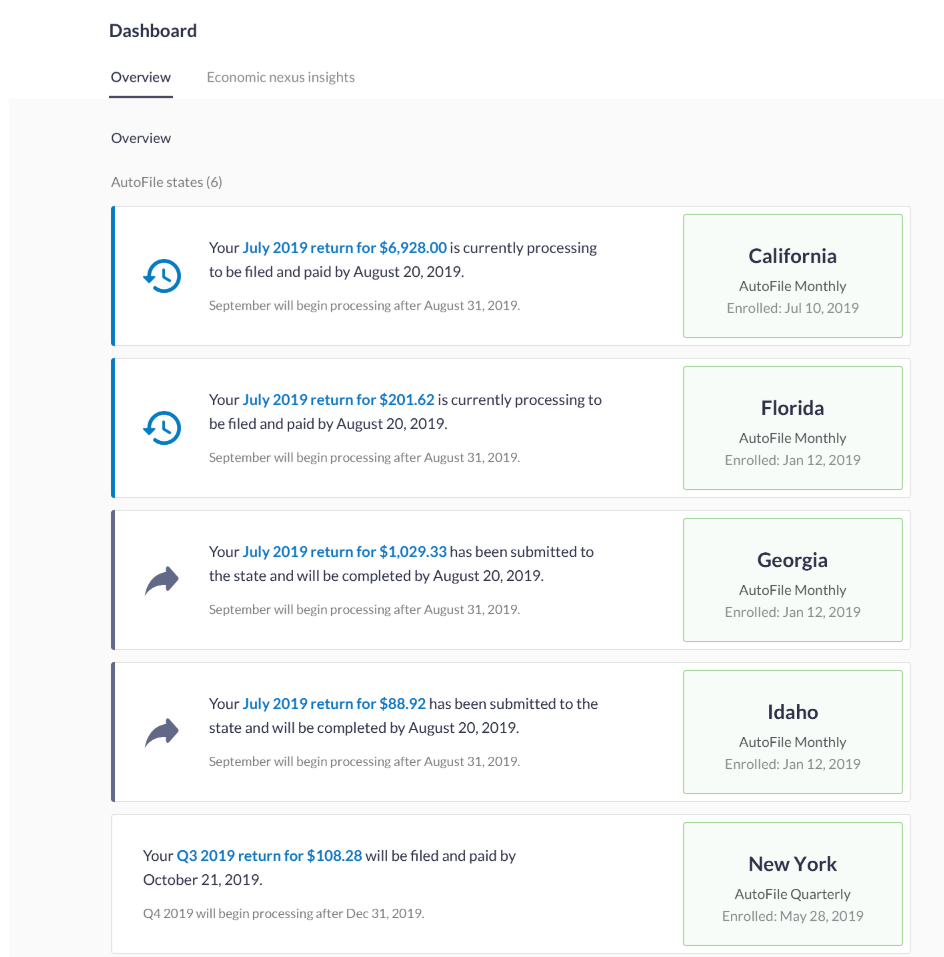

3| Automatically submit your returns

More sales often means having to remit taxes to more states. The whole point of determining and tracking economic nexus is to prepare you to pay those taxes accurately and on time. You’ll need to know and track whether you submit taxes monthly, quarterly, or yearly and then manually submit your paperwork. Alternatively, you could choose a solution that will automate your returns to the states where you’re registered to ensure you never miss a due date.

Sales tax can be complicated, but it doesn’t have to be. Use your resources – both people and TaxJar – to simplify sales tax and free up your time for more important things – like growing your business. Start a free, 30-day TaxJar trial today.