A global view of taxation

by October 25, 2024

With the rise of new e-commerce technologies and platforms, many companies are finding it easier than ever to expand into new countries. This trend of cross-border expansion shows no signs of slowing down. The global cross-border e-commerce market, valued at $785 billion in 2021, is projected to reach an astounding $7.9 trillion by 2030.

However, when selling internationally, there are many factors to consider, one of the most important being the varying requirements for indirect tax compliance. Indirect taxes, which are applied to the retail sales of certain tangible goods and services, are paid by the consumer and remitted by the business to the appropriate tax authority. While the management of these tax types can differ by region, one constant remains: the customer is responsible for paying the tax.

In this article, we’ll explore the different types of indirect taxes businesses may encounter when selling internationally, and share how to manage tax compliance in various regions.

Sales tax

Sales tax is a type of indirect tax in the US. Sales tax is governed at the state level, which means each state gets to make its own rules and laws when it comes to administering sales tax. For a business selling in multiple states, they must be aware of all the different sales tax laws and keep up with when sales tax is due in each state.

Retailers are required to collect sales tax from buyers in states where they have sales tax nexus. There are two different types of sales tax nexus, or in other words, two different ways you can meet the requirements to collect and remit sales tax to a state. Physical nexus is just that, a physical connection to a state. Examples of physical nexus (also sometimes referred to as “physical presence”) include employees, offices, stores, warehouses, conference attendance, servers, etc.

Economic nexus is based on certain economic or transaction thresholds set by each state. Once a business exceeds a threshold in a state, they are required to register and collect sales tax from customers in that state.

Value-added tax (VAT)

VAT is another type of indirect tax that applies to digital and physical goods or services sold, most commonly found in Europe. Similar to the US, each country can set their own VAT rates.

Unlike the US sales tax system, the VAT system is a multi-stage tax that is imposed at every step of the supply chain. The VAT is due in the country of consumption regardless of the country of the seller.

In most cases, VAT is due on the receipts paid for the “output” of a good or service. VAT ranges from 15% to 25% so it can be a significant element of the transaction costs. Any VAT paid by the seller on the supplies or services consumed in producing the product sold, is used as a credit against the tax that has been collected.

Goods and services tax (GST)

GST is commonly found in Canada and Australia. Similar to sales tax, GST is an indirect tax that applies to purchases of goods and services. In Canada, in addition to GST, certain provinces have additional sales taxes called provincial sales tax (PST) that sometimes take on different names, depending on the province. You can learn more about managing GST in Canada here.

The Australian Tax Office (ATO) charges a broad-based GST of 10% on most sales to local customers. There are exemptions and concessions to this general standard for some purchases, including some basic foods, medical care, and health products.

How to manage global tax compliance

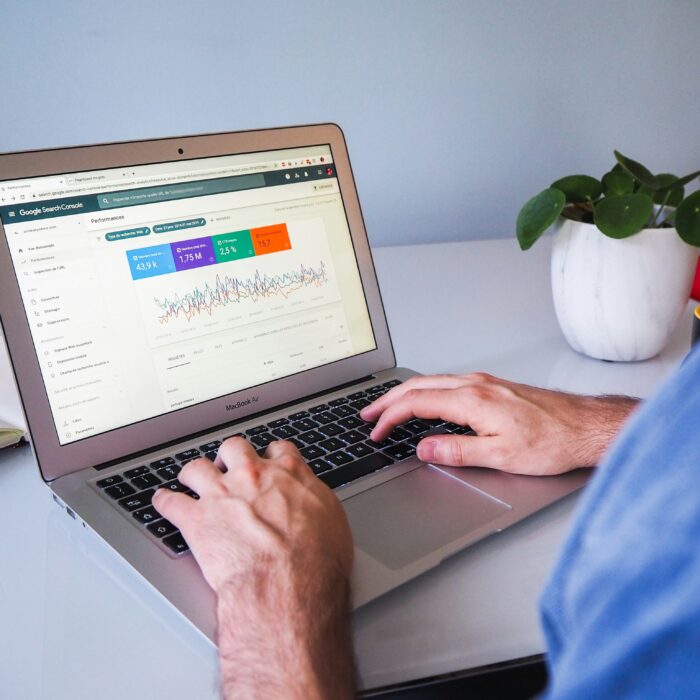

With all the various tax requirements that come with selling internationally, it’s no surprise that many businesses turn to tax automation software to manage their compliance. When evaluating tax automation software, it’s important to make sure the tool can support your compliance needs, wherever they might be.

Due to all the varying rules and regulations within the US tax system, many businesses turn to TaxJar to manage their US sales tax compliance. TaxJar makes compliance easier, by managing all the different aspects, including keeping you updated on where you have nexus, registering for sales tax permits, and automating sales tax filing and remittance. To learn more about TaxJar and get started automating your sales tax compliance, start a free, 30-day trial today.

While TaxJar does not offer international tax support, Stripe Tax might be a good fit for businesses looking for global tax compliance support. TaxJar was acquired by Stripe in 2021 to accelerate the future of commerce and compliance. Available in over 60 countries, Stripe Tax enables you to automatically calculate and collect the right amount of tax based on where you are registered, where your customers are located, and what you are selling. Stripe Tax also helps you monitor your obligations and provides reporting as well as global filing and remittance. Additionally, Stripe Tax is built to fit seamlessly into your existing payments processes or billing system, so you can integrate the way you want. Learn more about Stripe Tax here.