Is shipping in Florida taxable?

by February 14, 2024

Please note: This blog was originally published in 2020. It’s since been updated for accuracy and comprehensiveness.

Perhaps your business is headquartered in the Sunshine State, or you have a remote employee working from the state, or inventory stored in a warehouse there. No matter what, you know your business is required to collect sales tax on any taxable items you sell to your customer.

But are the shipping and handling charges you collect from the buyer also taxable? We took a look:

Sales tax on shipping in Florida? It depends…

As with many sales tax related questions, here is no straight answer when it comes to shipping taxability in Florida. Often, shipping IS taxable, and you must collect sales tax on this charge and figure it into your calculations.

There are exceptions, though, which complicate things. In fact, if your order meets two separate criteria, then shipping is NOT taxable. These two criteria are:

- The charge is separately stated on a bill or invoice

- The charge can be avoided by a decision or action solely on the part of the purchaser

In other words, if your customer decides to take matters into their own hands and drive to pick up the item AND you had already listed the shipping charge separately on the invoice, the charge is not taxable. On top of that, though, if you even PRESENT the option for them to come pick it up, it’s not taxable.

So let’s say you have a business that sells Halloween decorations in Jacksonville. A customer who lives in Jacksonville buys a spooky skeleton. You give them the option to pick the item up and list the shipping separately. Whether or not they actually pick it up, the shipping cost is NOT taxable.

However, another customer from Miami also buys a spooky skeleton. There is no easy way for them to pick it up so you don’t give them the option. Even though you listed the shipping cost separately, shipping IS taxable in this scenario.

Further, in our understanding, if you sell through a fulfillment service like FBA, the shipping and handling charges aren’t separated out and there’s no way for your customer to pick up the item, so shipping in Florida is taxable for FBA sellers.

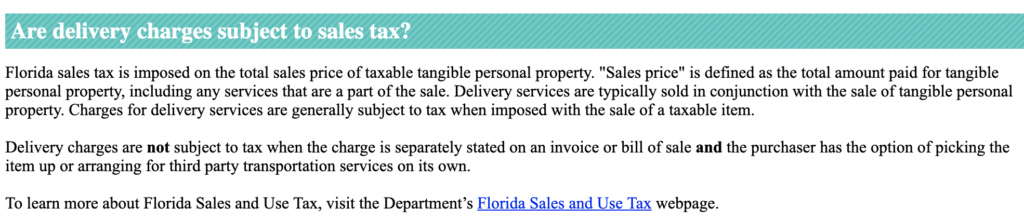

Here is Florida’s policy on shipping straight from the Florida Department of Revenue:

Sales tax on shipping in Florida

In Florida, whether or not you are required to collect sales tax on shipping charges depends.

If you charge for shipping and do not offer your customer the option to pick up their item, then shipping is taxable.

If you do not list shipping separately on the invoice, shipping is taxable.

But if you list shipping separately on the invoice and give your customer the option to pickup their purchase, then shipping is non-taxable.

Handling Florida shipping and handling sales tax with TaxJar

The TaxJar app defaults to the most common Florida scenario – that shipping and handling is non-taxable.

However, if your business does charge sales tax on shipping, then TaxJar’s Shipping & Handling Override allows you to update that in your state tax settings. This will make the Florida Expected Sales Tax Due Report more accurate. This will also tell the TaxJar API to charge sales tax on Florida shipping.

Learn more about how TaxJar treats shipping and handling here.