Is shipping taxable in Texas?

by February 22, 2024

Please note: This blog was originally published in 2015. It’s since been updated for accuracy and comprehensiveness.

Sales tax is a tricky subject and it gets even more confusing when all of the different state governments set their own rules for how it is applied and when. It becomes an even foggier subject when you get to small subjects like whether or not sales tax is applicable to shipping charges. Let’s see how Texas solves this for sellers.

Is shipping taxable in Texas?

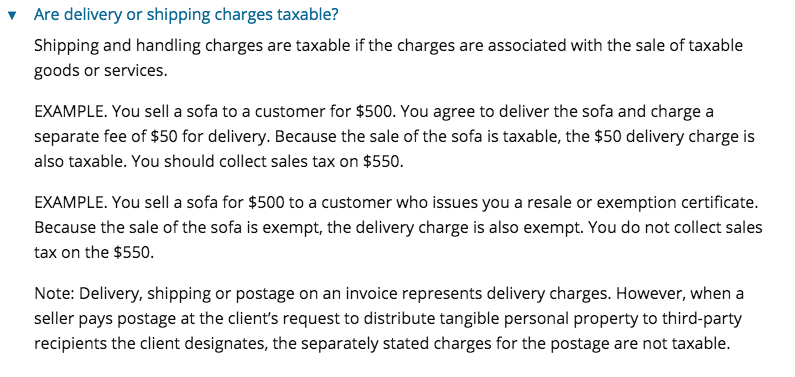

The Texas Comptroller has this to say on the matter:

This is simple enough. If you sell an item and charge shipping or delivery charges, then you should also charge sales tax on those shipping/delivery charges.

You will most likely charge sales tax on shipping and handling in Texas.

If you are selling an item that is taxable and you ship it, the shipping and handling is taxable. The only way it ISN’T taxable is if your customer gives you:

- A properly completed Resale Certificate.

- An Exemption Certificate.

Other than that, you are going to have to charge your buyer sales tax on shipping and handling.

To learn more about TaxJar and get started, visit TaxJar.com/how-it-works.