California sales tax prepayments, explained

by February 28, 2025

California is one of the tricker states when it comes to sales tax. And it can get even tricker for high volume sellers due to a requirement for sales tax prepayments. If you’ve been notified about California sales tax prepayments – congrats! You’re probably doing something right in your business. Read on to find out what I mean.

This post will explain who has to make prepayments to the California Board of Equalization and how to make this task a little less onerous with TaxJar‘s help.

Who has to make California sales tax prepayments?

According to the California Board of Equalization (BOE), sellers who make an average in taxable sales of $17,000 or more per month in California must make sales tax prepayments.

The BOE goes on to say that you will be notified in writing should you be required to make these prepayments. So don’t assume you need to make prepayments until you’re notified. On the other hand, if you’re approaching (or have reached) this threshold, be sure to keep your address updated and read all of your mail from the California BOE.

Note: If 75% or more of your sales are of fuel products, you may be exempt from prepayments.

When are California sales tax prepayments due?

Sales tax prepayments are due by the 24th day of the month in every month when you don’t file a sales tax return.

It’s probably easier to explain this using an example.

If you aren’t required to make sales tax prepayments:

In this example you are a California seller who is required to file and remit sales tax quarterly. In this scenario, you only have to deal with the state of CA 4 times per year – when you make your quarterly filing and payments.

If you are required to make sales tax prepayments:

Now in this scenario you are a California seller required to make sales tax prepayments. You still need to file sales tax on your quarterly due dates, but you need to pay what you collected from the previous month every other month by the 24th of the month. (You don’t have to send in a prepayment in the same month where you have a quarterly sales tax filing due date.)

Here’s an example calendar:

January 31st – Q4 quarterly sales tax filing due date. File your sales tax return and pay any sales tax due.

February 24th – Your first prepayment. Pay the sales tax you collected from buyers in January

March 24th – Your second prepayment. Pay the sales tax you collected from buyers in February

April 30th – Q1 quarterly sales tax filing due. File your Q1 sales tax return and remit the remainder of any sales tax you owe for Q1 (January-March). If you made your prepayments, you would only remit the sales tax you collected in March.

The CDTFA has also published a handy chart of sales tax prepayment and sales tax filing due dates.

How much should you prepay?

In the example above, I simplified how much sales tax you should prepay. For the most part, California only requires you to send them 90% of the sales tax you collected the previous month as a prepayment. (So in the February example above, you would only be technically required to send in 90% of the sales tax you collected from customers in the month of January.) This gives you some leeway in figuring out just exactly how much you collected and owe.

Unfortunately, the penalties for failing to pay at least 90% of your prepayment owed in California can be steep. Since technology like TaxJar allows you to determine how much sales tax you’ve collected in a month, I think it’s easier just to pay the amount you collected from customers in that previous month.

If you do want to keep an eagle eye on your sales tax prepayments and only pay as much as the letter of the law requires (and I totally understand why you might!), California has published a guide to prepayments here. This guide will walk you through exactly how much you need to prepay in each month to stay aboveboard.

Handling California prepayments with TaxJar

TaxJar connects with the shopping carts and marketplaces you sell on and slices and dices your sales tax info into the format your state – in this case, California – wants to see. We’ll also AutoFile your sales tax returns for you to take sales tax completely off your plate.

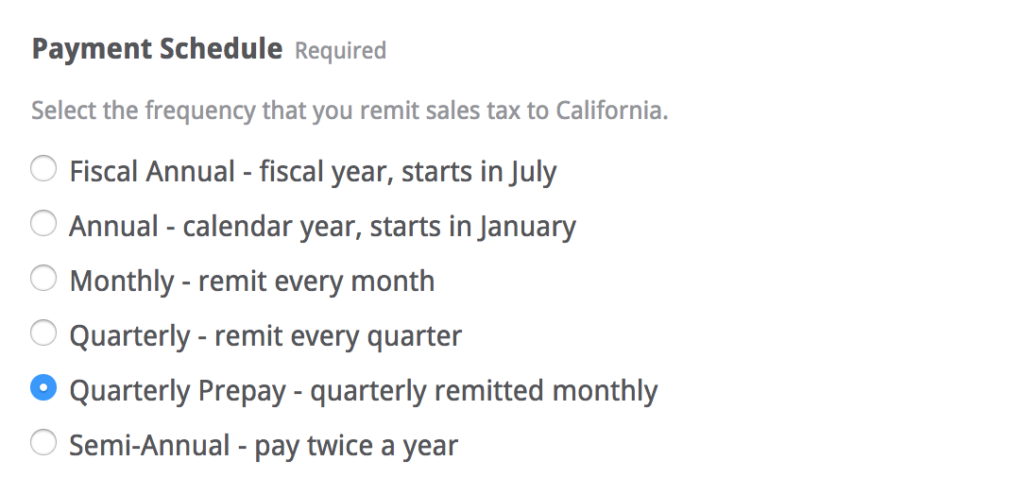

Whether you file your own California sales tax returns manually or use TaxJar AutoFile to automatically file your sales tax returns, all you need to do to change your filing frequency is:

- Visit your Account page at https://app.taxjar.com and click State Settings on the left.

- From there, click the Edit link next to California to change your payment schedule to “Quarterly Prepay – quarterly remitted monthly” then click the green “Save” button and you’re all set!

Now you’re ready to file in California. For a step-by-step guide, check out our “How to File a California Sales Tax Return” blog post.

More California sales tax resources

California Sales Tax Guide for Businesses

How to file a California sales tax return

To learn more about TaxJar and get started, visit https://www.taxjar.com/product.