How to update your California sales tax account

by May 18, 2018

Please note: This blog was originally published in 2018. It’s since been updated for accuracy and comprehensiveness.

The California Department of Tax and Fee Administration (CDTFA) updated their online sales tax filing system. As of May 2018, sales and use tax accounts were moved to the CDTFA’s new online system.

Many TaxJar customers have received email notification of this change, and we’ve had questions from TaxJar customers concerned about whether these requests are legitimate or some sort of phishing attempt. Rest assured, California really updated their system, and all online sellers who currently file and pay California sales and use tax online should follow the instructions to update your login details.

Also, if you use TaxJar to AutoFile your sales tax returns, you will need to take a vital extra step.

Here’s what you need to know:

How to update your California sales tax account

If you have previously filed and paid sales tax online through California’s online portal, your current User ID and Password will not be valid in the new system. We recommend updating your new login details as soon as possible because you will be required to wait 7-10 days for a mailed login code.

Here are the written instructions:

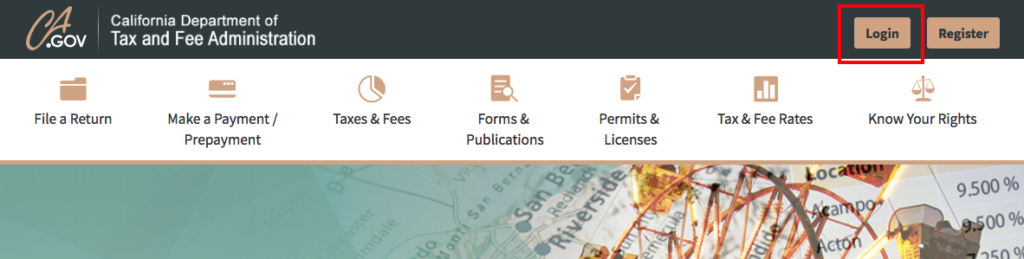

- Go to www.cdtfa.ca.gov

- Click the Login button.

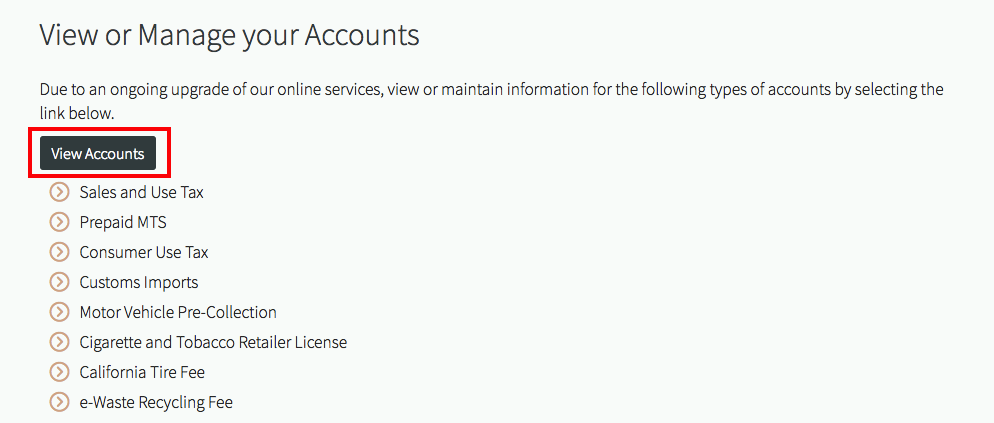

- Scroll down and click the gray “View Accounts” button under the “View or Manage Your Accounts” heading.

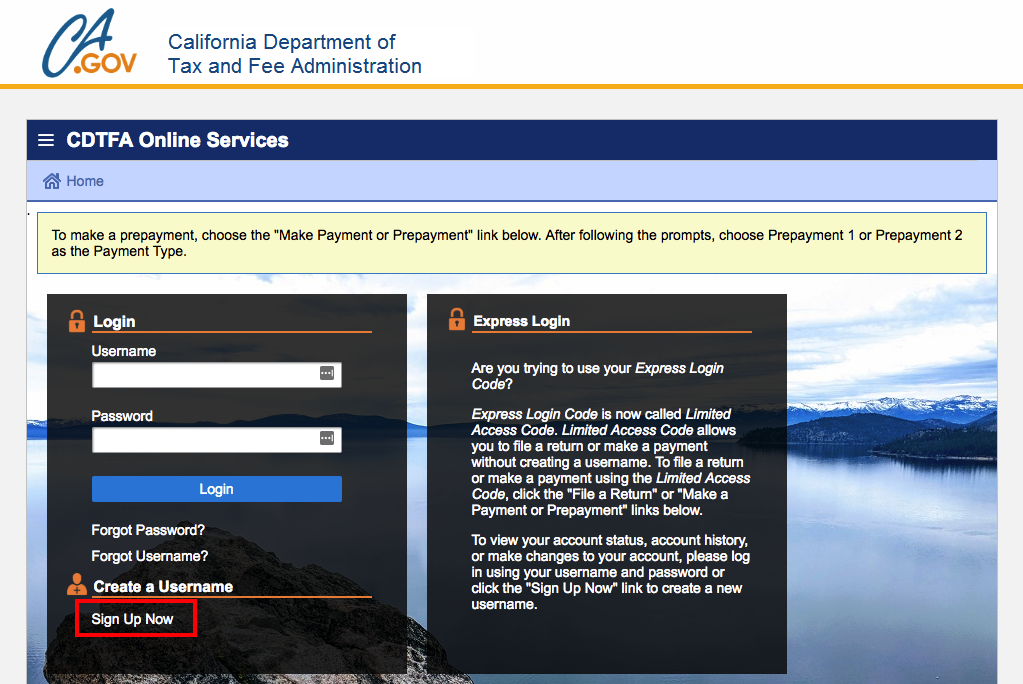

- On the next page, click on “Sign Up Now.”

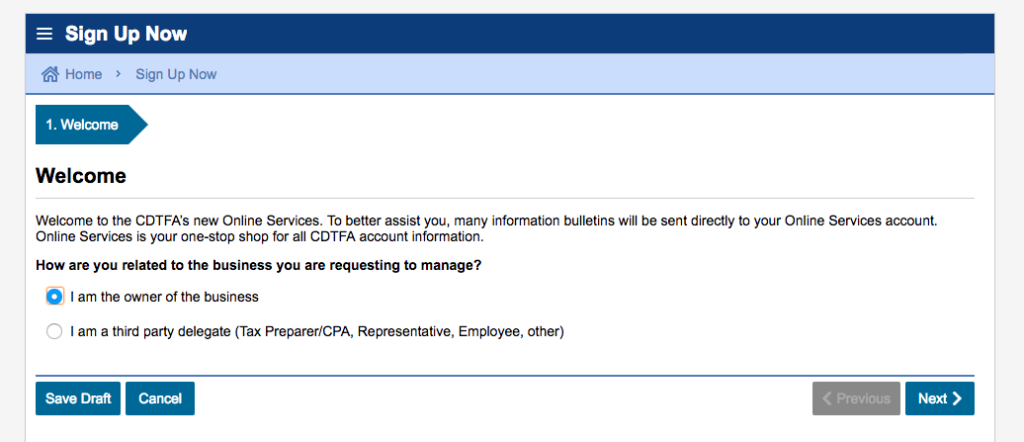

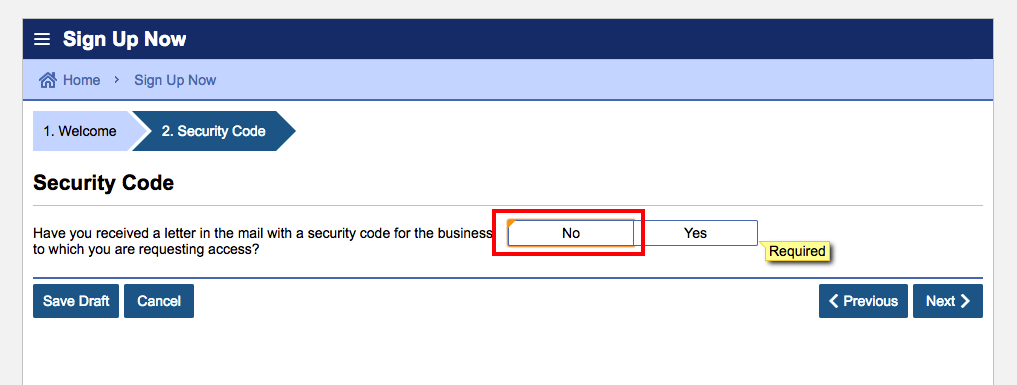

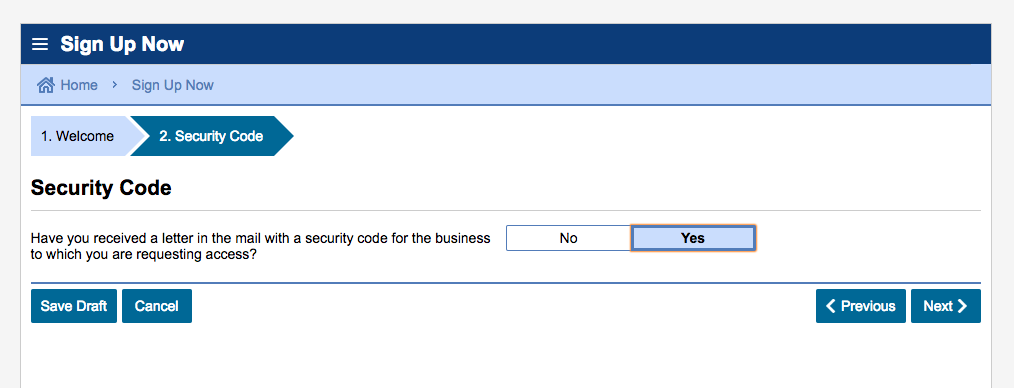

- Over the next two pages, you will be prompted to enter your identifying information and request a security code. Keep in mind that only the account owner (not a 3rd party, employee, etc.) can request the necessary information.

- Please request a security code and allow seven to ten (7-10) business days for the code to be delivered to your business mailing address.

Once you receive your security code, you will return to www.cdtfa.ca.gov and repeat the steps above to set up a new Username and Password and access your account. Here are the steps to enter your new code:

- Return to www.cdtfa.ca.gov

- Click the Login button.

- Scroll down and click the gray “View Accounts” button under the “View or Manage Your Accounts” heading.

- On the next page, click on “Sign Up Now.”

- You will be prompted to enter your security code.

From there, you should be all set to continue filing your California sales and use tax returns online.

One additional step for TaxJar AutoFiler users

If you use TaxJar to AutoFile your California sales tax return, there will be an extra step once you have received your new code from the CDTFA.

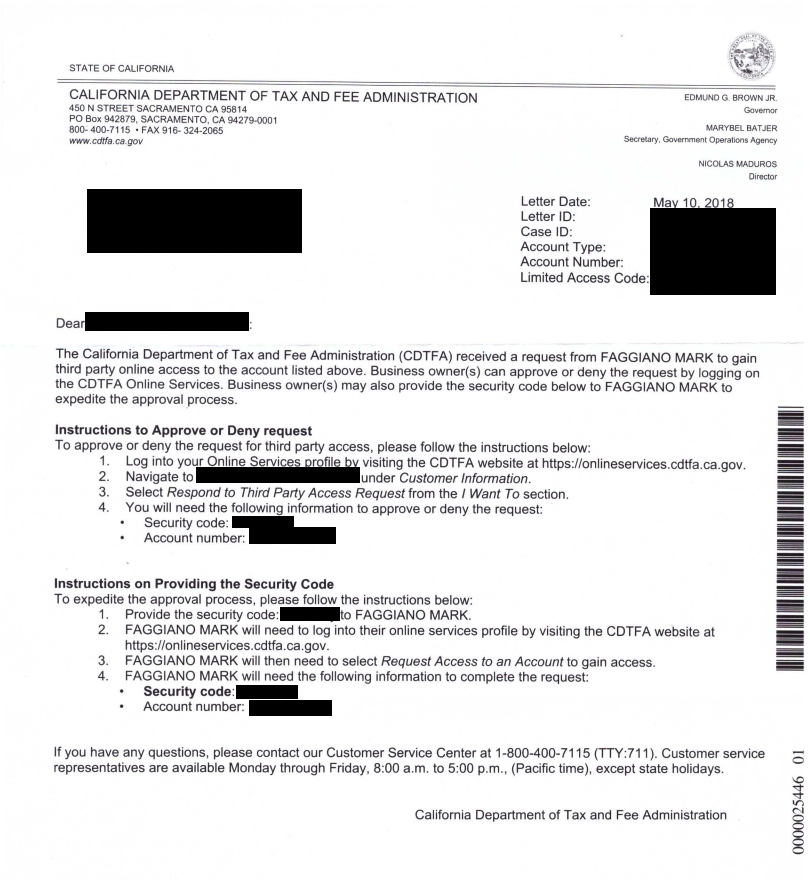

- First, wait to receive a second mailed letter from the CDTFA. This letter will look like the example below, and will state that TaxJar has requested 3rd party account access. This is the access we need in order to AutoFile your sales tax return. (Warning: Your personal security code from the CDTFA will not work here. This has to be the 3rd party access security code requested by TaxJar.)

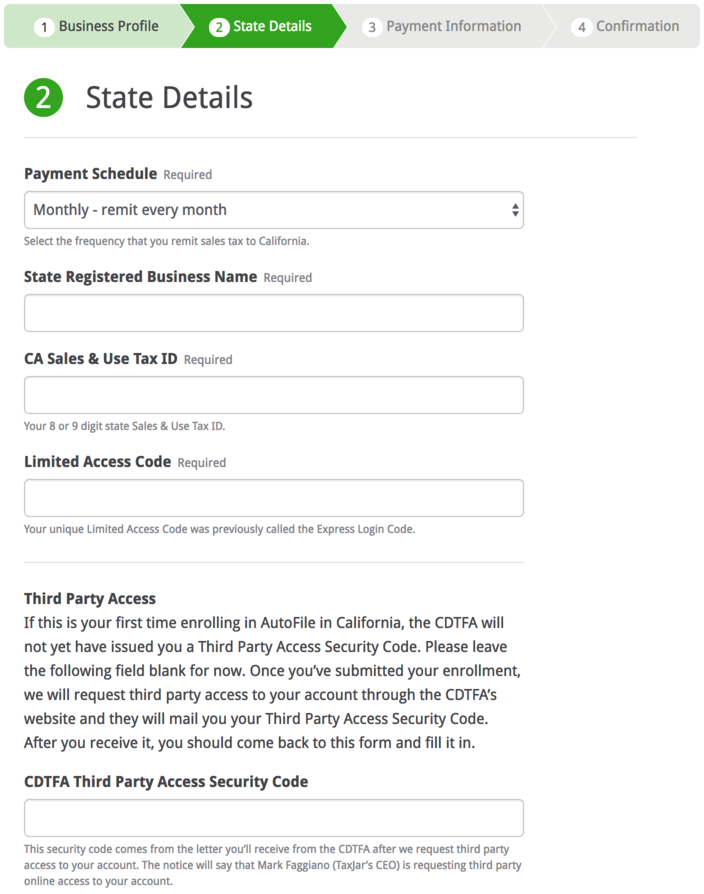

- Please login to TaxJar to update your California AutoFile enrollment form with the new CDTFA third party access security code in the State Details section of the enrollment form:

- Click the Green “Continue” button at the bottom of the screen until you reach the last section of the form:

- When you reach the last section, click the green “Save California Enrollment” button to submit your new details for review by our Filing Team:

- Your Dashboard will now say that your CA AutoFile enrollment is “Pending,” which means your updates are in the queue for our Filing Team to confirm the new details are accurate.

- This typically takes a few business days to process, though it may take a bit longer due to the volume of California enrollments that need to be reviewed again.

- After your enrollment has been reviewed and confirmed by our Filing Team, you’ll receive an email confirmation that you are now enrolled in AutoFile for California (again).

- Once you receive that email, your CA enrollment update will be complete!