Amazon FBA sellers: Sales tax request from San Bernardino, CA

by November 1, 2023

Please note: This blog was originally published in 2020. It’s since been updated for accuracy and comprehensiveness.

One of our sales tax expert partners, Catching Clouds, recently brought a new sales tax notice from a California city to our attention. Fortunately this was not what you might expect. This post will explain what’s happening and what to do if you receive the same notice.

The San Bernardino sales tax notice

The city of San Bernardino, home to the ONT2 Amazon fulfillment center, recently began reaching out to Amazon FBA sellers. According to them, any sales made from the ONT2 fulfillment center to buyers in the city of San Bernardino should be allocated to the city of San Bernardino on your California sales tax filing. They also wanted to see any sales made out of ONT2 that shipped to any buyer in California.

What’s going on? Apparently, with the restructuring of the California Board of Equalization (BOE) into the new California Department of Tax and Fee Administration (CDTFA), some things are changing when it comes to California sales tax.

It appears that someone realized that some sales tax was misallocated and San Bernardino wasn’t getting their fair share. Now they are turning to sellers for further information.

What to do if you receive the San Bernardino notice

We have now talked to two sellers who received this notice. In both cases, the sellers were asked to recalculate how much sales tax should have gone to San Bernardino over the period of about one year. (This time period varied by seller.)

Fortunately, neither seller as asked to go to the trouble of filing an amended return. However, they were still asked to slice and dice numbers in their Amazon account.

Katie Renon with Catching Clouds explained how they crunched the data for their client.

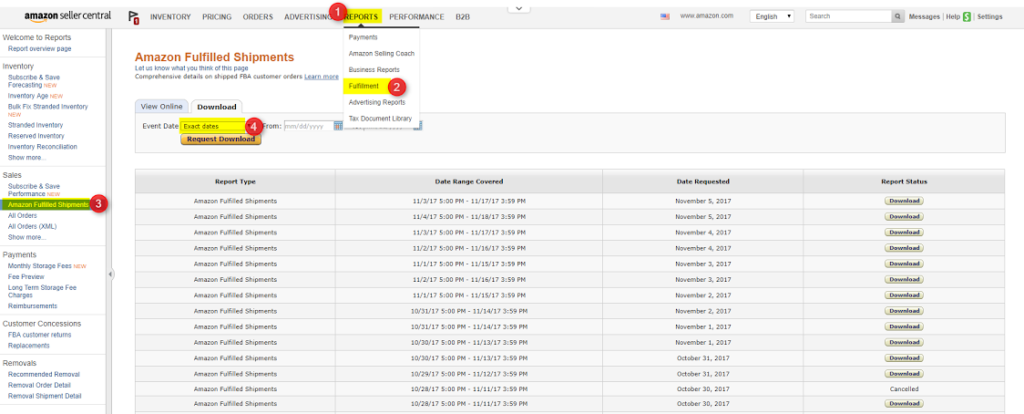

- In Seller Central, find the category “Fulfillment Report”

- On the left-hand side under “Sales” find a report called “Amazon Fulfilled Shipments”

- “Amazon Fulfilled Shipments” only pulls 30 days at a time. Pull the reports as needed for the taxable periods California has asked you to amend

From there, transfer all data into a single spreadsheet to make it easier to handle. Then:

- Filter by column “AT” – that will show you the fulfillment center from which your orders shipped. Since you are only dealing with ONT2, you can delete everything else to make your spreadsheet more manageable.

- This is where advanced Excel and pivot tables come in. (If you’re not familiar with pivot tables, here’s a Microsoft Excel Pivot Table tutorial.)

- From here, filter by “Shipment State,” “Item Price” and “Item Tax”

After that, Katie was able to use the data to give the revenue agent what he requested, which was:

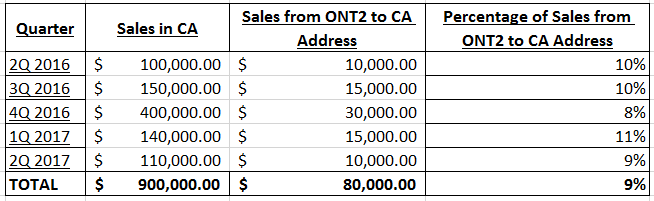

- Total sales for each quarter

- Total sales that were shipped to the city of San Bernardino

- Total sales shipped from the ONT2 warehouse to San Bernardino addresses

- A percentage of how many sales to San Bernardino buyers came from the ONT2 warehouse

The final output shared with the revenue agent looked like this:

From here, the California sales tax agent presumably used this information to reallocate the sales tax that the Amazon FBA seller had already paid via his previous California sales tax filings. Fortunately, this did not require the seller to file an amended return, only provide information to the state of California so that they could make sure the sales tax went to the correct local government where it belonged.

As you can see, finding the information the California revenue agent is a bit complicated, and requires crunching numbers. If you receive this notice, we recommend contacting Catching Clouds, since they already have the data you need in place to find your San Bernardino, California sales information on your behalf.