How to file a quarterly sales tax return in California

by February 1, 2025

Filing your quarterly California sales tax returns can be challenging, which is why we created TaxJar. TaxJar’s state reports simplify the process of filing a return and can save you hours spent on managing sales tax. We wrote this post as a step-by-step guide for using TaxJar’s report to fill in the info you need to file your quarterly California sales tax return.

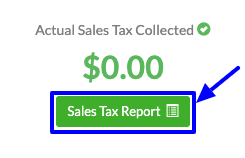

Open your TaxJar report for California:

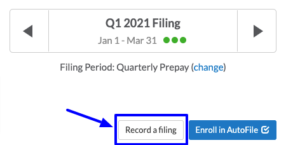

Select the Record Filing button at the top of your report

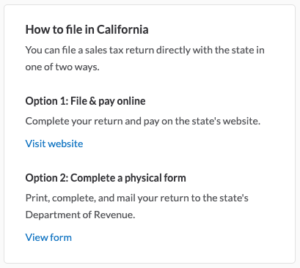

Use the links on the top right to locate the state’s filing website or download a paper form.

Ω

Ω

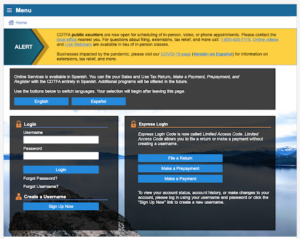

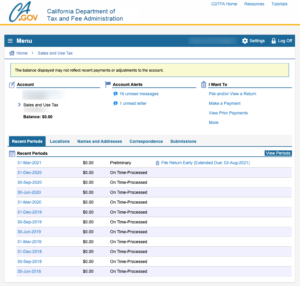

Copy the information from your TaxJar Expected California Report into the state’s website. View detailed instructions on using TaxJar Reports to file a return, including a note on how to file when Marketplace Facilitator Tax is collected. Login to the California Department of Tax and Fee Administration website in a separate tab.

Under the Accounts tab, click Sales and Use Tax. This will take you to your available filings. Choose the correct period and click “File Return.”

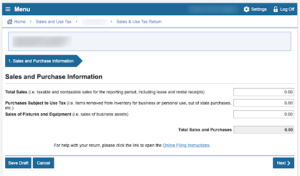

Enter your Total Sales – Use the “Gross Sales” amount from your California state Expected TaxJar report. Enter any other values pertinent to your business in “Purchases Subject to Use Tax’ and “Sales of Fixtures and Equipment.” Click “Next.”

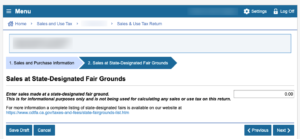

Enter your Sales at State-Designated Fair Grounds. For most businesses this would be $0, but if you happen to have these sales, you would enter the value here. Click “Next.”

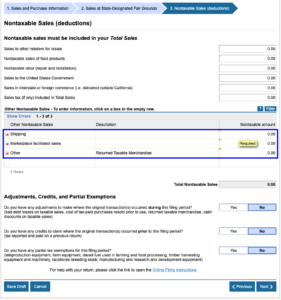

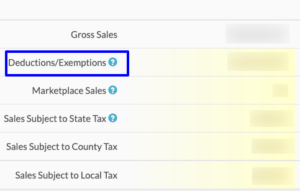

Enter your NonTaxable Sales (Deductions). Some of the more common deductions we see are for Shipping, Marketplace Facilitator Sales and Returned Taxable Merchandise. As an example, these deductions are shown below. Enter your own “Nontaxable Amounts” for each of the deductions that may be relevant to your business.

You can find these deductions and amounts in the Deduction/Exemptions area of your TaxJar Expected Sales Report.

Answer the three questions under “Adjustments, Credits, and Partial Exemptions as they pertain to your business. Click “Next.”

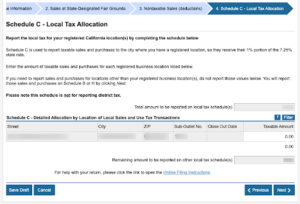

Some businesses are now required to file a Schedule C. Schedule C is used to report taxable sales and purchases to the city where you have a registered location, so they receive their 1% portion of the 7.25% state rate. If this applies to your business, complete this step and then click “Next.”

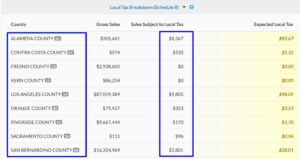

View your California Schedule B report on TaxJar (if the California system prompts you to file Schedule B). To see your schedule B report in TaxJar, click the blue “Schedule B (County Tax Breakdown)” tab on your California Expected State Report. Keep in mind that not every seller will be prompted to fill out Schedule B. If you aren’t, you can skip this step and the next one.

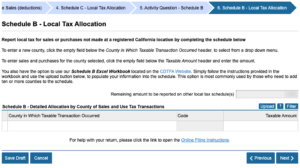

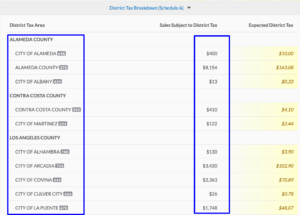

Fill out Schedule B (Remember, not all sellers will file Schedule B). The two highlighted columns contain the information that needs to be input on your schedule B. California requires that you round up or down to the nearest dollar amount. Your TaxJar California state report provides these numbers to you already rounded so all you have to do is enter the number shown in your California sales tax filing.

When you’re finished, all of the taxes input should amount to 1% of your “sales subject to state and local tax”.

What if your numbers don’t quite match? This can happen due to rounding. Read more about how rounding can cause your sales tax filings to be a few cents or dollars off here.

View your California Schedule A report on TaxJar. Schedule A is also known as your “district taxes” form. Click “Schedule A (District Tax Breakdown)” on your California Expected state report in TaxJar.

Fill out Schedule A. Input the County, City and Taxable Input into the Schedule A. You can find these values in your TaxJar Expected State Report as highlighted above. This time you enter the amount of sales you made, not the amount of sales tax you collected. Just like with Schedule B, TaxJar has rounded these amounts up or down to the nearest dollar amount so all you have to do is transfer the numbers from TaxJar to your California sales tax filing.

Once again, due to rounding, the numbers may be up to a few dollars off.

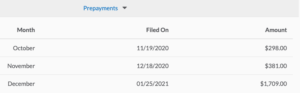

Detail any Prepayments that you have made. If you have made any Prepayments during the quarter you would record them here.

Your prepayments can be found under the “Prepayments” section of your TaxJar Expected State Report.

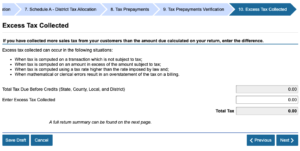

Detail any excess tax collected.

Check your work! Once you have filled out your California sales tax filing completely, the “Remaining Tax Due” at the bottom of your California sales tax filing should match within a few dollars of your “Expected Sales Tax Due” on your TaxJar California report.

Watch for exceptions. Some districts might be listed twice. This could be because the tax rate in that area may have changed during the taxable period. You can avoid any problems here by making sure that the district numbers match up on your TaxJar California state report and on your Schedule A.

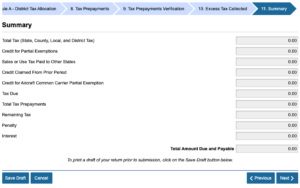

Verify the information on the summary pages.

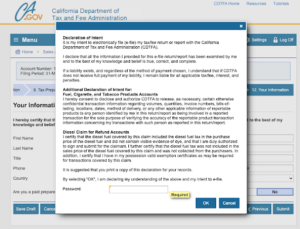

Enter Preparer Information, and then click next.

Submit your return by entering your password and then follow the instructions to pay your sales tax. Be sure to save and print a copy of your return!

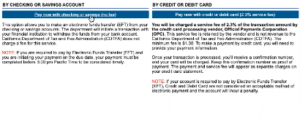

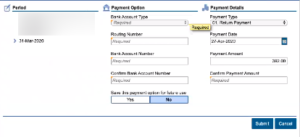

Make your payment and save a copy of your receipt

And that’s it! You’ve used your California state report in TaxJar to save hours filling out your California sales tax return!

Record your filing & payment with TaxJar for organized sales tax records and easy-access at a later date.