Understanding rounding in sales tax reporting

by November 28, 2024

Several states have pretty strict validation checks in their online filing forms that make it very difficult, if not impossible, to file the exact amount you actually owe.

In other words, depending on how the state asks you to fill out your sales tax filing form, the amount of sales tax you collected and the amount the state thinks you owe may never quite match up.

As a former sales tax auditor, I’ve seen this quite a bit in my professional life. This post will run through some scenarios where rounding causes the state to want you to file a slightly different amount of sales tax than what you actually collected.

To make things easy here, we are going to assume that you are filing sales tax in a state like California. To make this scenario simple, we’ll assume a state rate of 6.25%, a statewide local rate of 1%, and a uniform district tax of 1%.

Be warned: this post gets a little technical and math-heavy. If you want to skip all the details, the high-level recap is that due to the fact that most states want you to use some form of rounding when filing your sales tax returns, the amount of sales tax you collected and the amount of sales tax you actually file may be off by a few pennies or a few dollars, depending on variables such as your sales volume, your pricing, and the number of taxing jurisdictions you owe taxes to.

Problem 1: Item-level calculations vs. invoice-level calculations

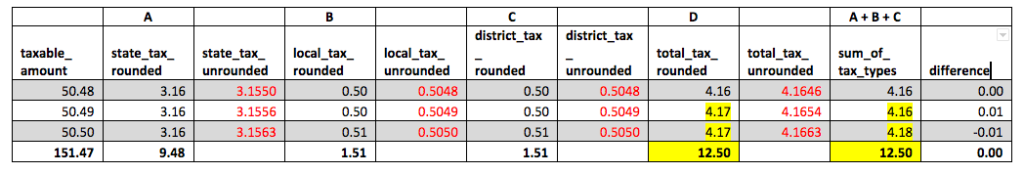

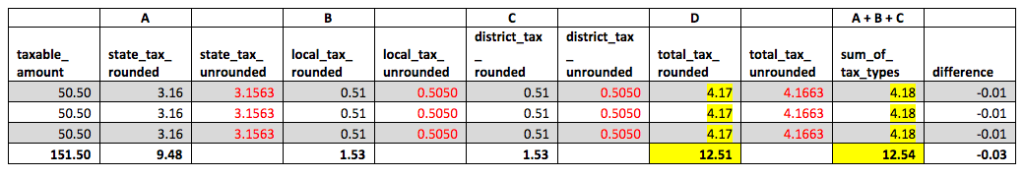

Most states allow the option to either calculate sales taxes on either each item sold or on the invoice taxable total. In the following examples, let’s assume that each row is a single item from an invoice you’ve sent your customer.

Notice that, in the second and third items, the state, local, and district taxes when summed separately (A + B + C) is a penny different than the calculation of the total rate multiplied by the taxable amount. This results from a “happy coincidence” when multiplying, rounding, and summing certain decimals. In this example, the rounding differences cancel each other out, and the effect is a wash when calculating tax with the total tax rate (both calculation methods come to $12.50).

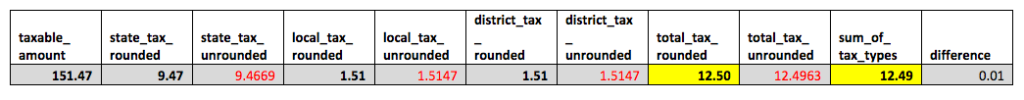

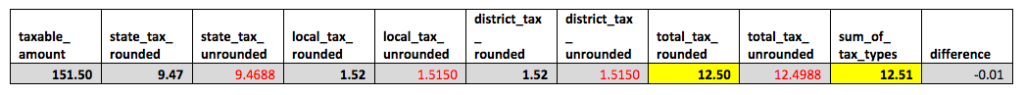

Here, we perform the same calculations as above based on the invoice totals instead of the individual items. Each tax is calculated by multiplying the rate by the invoice taxable total.

In this case, the wash effect above prevented any discrepancy between the two methods for the total tax calculation.

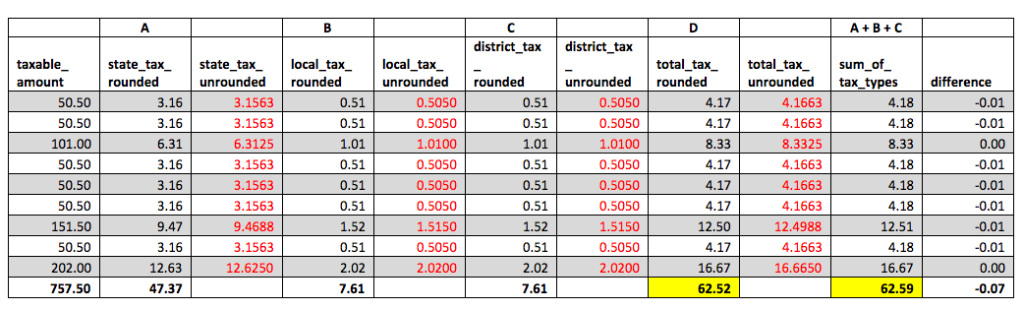

We will further simplify now by assuming this vendor only sells one type of item at one price. This will magnify the effect of rounding differences so we can see it more clearly in only a handful of transactions.

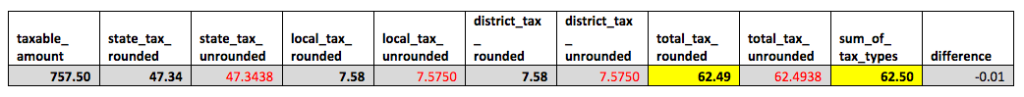

Now we will calculate the taxes using the invoice totals instead of each line item.

Depending on whether or not you calculate state, local, and district taxes individually or just use the total tax rate, you could have a difference of up to 3 cents for an invoice with only 3 items.

Takeaway

As you can imagine, the higher your sales volume and the more products you sell, the greater this discrepancy might be. When you start to file your sales tax return, you may see that the difference between what your books (or TaxJar) is showing that you actually collected, and what the state wants you to pay them, is off by several dollars. And this was all caused by rounding.

Problem 2: Item-level calculations or invoice-level calculations vs. filing-period-level calculations

The first problem also applies when totaling taxes by invoice in comparison to calculating taxes due by the total taxable sales for the entire filing period.

Totaling tax at the invoice or item level:

In this example, each row represents an invoice which consists of a sale of one or more items.

Totaling tax for the filing period:

Takeaway

In similar fashion to Problem 1, the difference between invoice level calculations and filing period level calculations is $0.03 when the aggregate tax rate is used and $0.07 when each tax type is calculated separately. Once again, if you sell many more items at different prices then your sales tax filing may be slightly off by an even higher percentage.

Problem 3: Multi-jurisdictional whole-dollar rounding

In a valiant effort to prop up the pillars of confusion, some states take rounding to the next level and require that dollar amounts be rounded to the nearest whole dollar. Using the same data from Problem 2, let’s walk through the basic steps of preparing a tax return for California and see what the effect of whole-dollar rounding is.

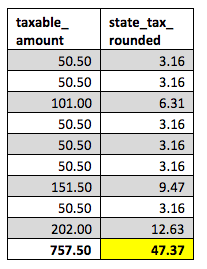

1. State tax:

Here is the state tax calculated at the invoice level and summed.

Here is the state tax calculated from the rounded total taxable sales. Although we are rounding before and after multiplying, there is not much room for error, because we are only doing this once. In this case, we only end up with a single cent difference.

![]()

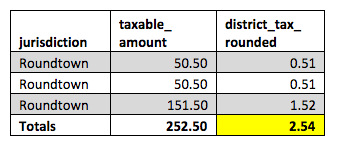

2. District tax (California Schedule A):

Here is the district tax calculated at the invoice level and summed.

Here is the district tax calculated from the rounded total taxable sales for that district. Similarly to the state tax, we do not have much of a difference here, but many businesses end up collecting district tax in dozens of jurisdictions each period, so the differences have the potential to add up.

![]()

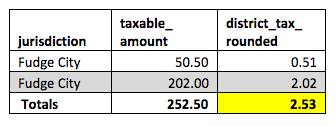

Here is the next district tax calculated at the invoice level and summed.

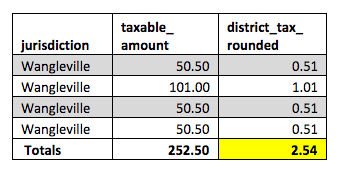

Here is the last district tax calculated at the invoice level and summed.

Here is the district tax calculated from the rounded total taxable sales for that district.

![]()

This is where the fun begins. The form for the online filing performs a validation check to make sure that the total taxable sales reported for all of the districts matches the total sales reported for the state. The more districts you are required to report for, the smaller the chance is that these amounts will reconcile. This reconciliation requirement essentially forces you to round up or down where you are not supposed to in order to force the puzzle pieces to fit.

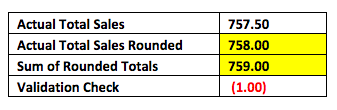

District validation check:

3. Statewide local tax

If California Schedule A got you feeling depressed, Schedule B or Schedule C is like a Monday morning after returning from vacation. Instead of the taxable amounts, we are being asked for the taxes due for each jurisdiction. This only further exacerbates the discrepancies caused by rounding.

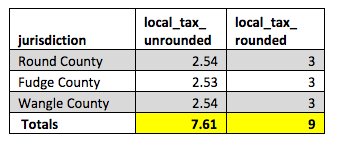

Here are the totals of the local tax calculated at the invoice level and summed compared to the amounts you are required to enter on the return.

As you can see, the differences add up very quickly here. We are already off by more than a dollar for only three counties.

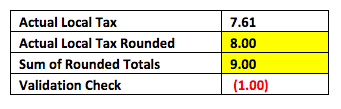

The validation check is even worse here than on “Schedule A,” because now we are required to adjust amounts up or down by tax dollars, not taxable amounts, to make the puzzle pieces fit.

Local validation check:

This failed validation check would require us to add an additional dollar of tax to a county to pass the control and be able to file. You can imagine how nasty this could get when you are filing dozens of local jurisdictions instead of just three.

The inevitable conclusion

You can do everything right, including rounding correctly, and still find that the state wants to see slightly different numbers from you.

Are you confused by this? We are, too. Let’s follow the leader by rounding off the logic and summing things up here.

You have a couple different CORRECT ways to collect your taxes, by item or by invoice. Even though you might have collected the taxes exactly how you were told to, you might end up having to pay an amount that is slightly higher or lower than what you collected. However, TaxJar can help.

As you can see, sales tax compliance is challenging. There are so many important details that businesses must be aware of to stay compliant and avoid penalties. TaxJar can make compliance easier, by managing all the different aspects, including keeping you updated on where you have nexus, registering for sales tax permits, and automating sales tax filing and remittance. To learn more about TaxJar and get started automating your sales tax compliance, start a free, 30-day trial today.

The author of this post is a former sales tax auditor taking a deep dive into rounding on sales tax returns.