Who is liable for sales tax at your company?

by February 23, 2025

Sales tax is a pass through tax — meaning it should never be paid out of your business’s pocket. Sales tax should be paid by customers and then remitted to the state. It only “passes through” the business, kind of like an intermediary. While the sales tax liability lies with the company, it should be paid by your customers. If you were to purchase a company, you’d also be purchasing their sales tax liabilities.

However, if the business isn’t collecting sales tax at all or collecting the incorrect amount, it will fall on the business owner to pay whatever sales tax amount is due. That’s why it’s so important to ensure you are collecting the correct amount of sales tax from the beginning.

So how does sales tax work? Where do I begin? Where are my sales tax obligations? We’ll walk you through it.

First things first — register for a sales tax permit where you will be collecting sales tax

How do you know which states you need to collect sales tax in? Let’s start with sales tax nexus. In short, nexus means a connection. There are two types of nexus, physical and economic. Physical nexus has been around for a while. If you have a physical presence in a state, you are likely going to be collecting sales tax in that state. Things like warehouses, employees, a headquarters, those all generally create physical nexus.

Economic nexus is a little trickier. This was established in the 2016 South Dakota vs. Wayfair Supreme Court decision. Essentially, it means if you are a remote seller and have hit a certain number of sales or reached the economic threshold in a state, you will be required to collect sales tax in that state. These thresholds vary by state, and it’s one of the reasons sales tax compliance has become a complex tax in the last few years, as more states create their own economic nexus laws.

Next question to ask yourself: is your product taxable? In the U.S., most “tangible personal property” is taxable. In other words, most items like furniture, jewelry, toothbrushes, coffee mugs, etc. will be subject to sales tax. Again, this varies by state.

Services are a little different, and the variations in how states have decided to tax those is all over the place. So if you sell a SaaS product to a customer in Georgia, you likely won’t be charging sales tax. Move over to Alabama though, and you’ll probably be charging sales tax to those customers. If you aren’t required to collect sales tax on your product in a certain state, you may not need to register for a sales tax permit there.

If you have determined that you need to register for a sales tax permit in one or more states, we have a full list of how to register for a sales tax permit in each state here. Don’t skip this step. It is unlawful to collect sales tax from buyers without a valid sales tax permit. While collecting sales tax without a valid permit may be an honest mistake on a business’s part, some states view this as tax fraud and take it very seriously.

Second step — collect the right amount of sales tax

Once you have your valid sales tax permit, your next step is to begin collecting sales tax from your customers.

Each online shopping cart and marketplace allows you to set up sales tax collection. Here’s where you can find guides on how to set up sales tax collection on the major shopping carts and marketplaces.

States generally require online sellers to collect sales tax in one of two ways:

- Origin-based sales tax collection

- Destination-based sales tax collection

This concept is also commonly referred to as “sales tax sourcing.”

Online sellers who are based in states with origin-based sales tax sourcing are required to collect sales tax at the seller’s business location. Online sellers who are based in states with destination-based sales tax sourcing are required to charge the sales tax rate at the buyer’s “ship to” address. In most cases, when selling to a buyer outside your “home” state, you would charge that buyer the sales tax rate at their “ship to” location. This can get a little tricky, but you can read more about origin and destination-based sales tax collection here.

Third step — remit sales tax to the state

Another thing that varies by state — sales tax due dates and remittance schedules. California might set one due date for sales tax collection, while Texas might be a few days later. Some states require quarterly payments, while for some, you might get away with only worrying about it annually. For a company selling in all 50 states, keeping up with those differing schedules is a full-time job in itself.

Most states allow you to file sales tax online, and some require it. If you wish to file manually, login at your state’s taxing authority website to file. At TaxJar, we recommend filing at least a few days early to avoid any problems with your filing and to deal with any state idiosyncrasies.

If a seller is accidentally late filing and receives a penalty, then the seller can often contact the state’s taxing authority and ask for a penalty waiver. This generally only works the first time a seller is late. However, it may even depend on the mood of the customer service agent that day!

You can find here the list of phone numbers for every state’s taxing authority. (Even though we live in the digital age, many states prefer that you call rather than ask for help online.)

Here are two key things to remember when filing a sales tax return:

- File “zero returns.” Do file a sales tax return every time you have a filing due, even if you didn’t collect any sales tax over the taxable period. States consider your sales tax filings to be a “check in.” If a seller fails to file, the state could charge a penalty or even revoke the seller’s sales tax license. Be prepared to file sales tax returns by the due date, every time.

- Don’t discount sales tax discounts. About half the states with a sales tax allow on-time sales tax filers to keep a very small amount (usually 1-2%) of the sales tax collected. While this amount may be small, it’s free money! Here is a list of states with sales tax discounts.

To sum up everything we’ve discussed here: the company is liable for making sales tax payments to the state. However, the company shouldn’t be making those sales tax payments out of pocket. If a business takes the time to set up their sales tax management process correctly from the beginning, they shouldn’t ever be paying sales tax to the state out of their own pocket. They will simply move the sales tax collections from their customers to the state.

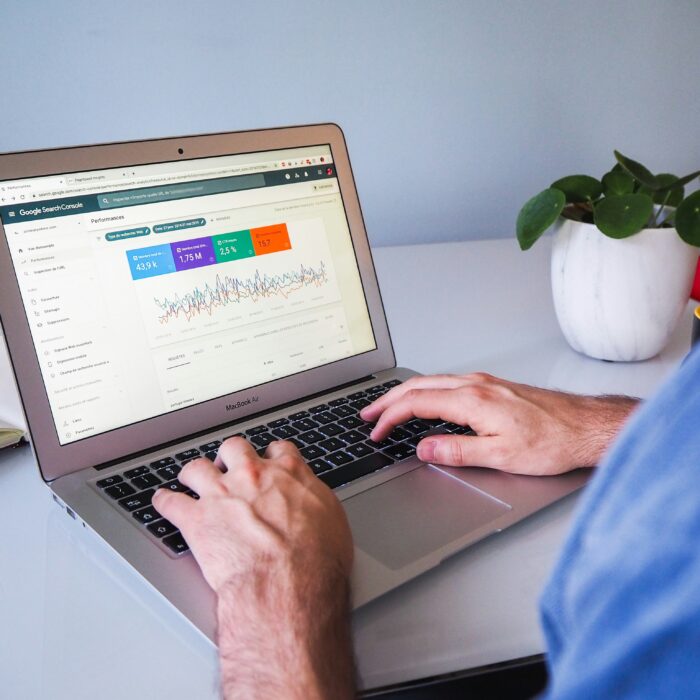

How TaxJar makes this easier for e-commerce sellers

Sales tax is tricky and not a revenue driver for your business. Finding the time to collect, remit and understand the nuances around sales tax takes away from growing your business. Rapidly changing laws, knowing where and when you must remit taxes, and setting up multi-state payments can be overwhelming for a store owner.

Automating your sales tax through a trusted solution like TaxJar not only saves time and headaches but allows you to focus on what’s most important: running your business. Swap the hours you’d spend navigating multi-state payment processes with automatic monthly reports, on-time filings, and friendly support when you need it the most.

TaxJar’s solutions are built to grow with you, so we’re ready for peak shopping times like Black Friday or Cyber Monday. We’ll stay on top of those state due dates so you don’t have to. And even better, with TaxJar’s AutoFile, we’ll automatically file your sales tax returns to the state for you. Built to support businesses with complex sales tax needs, TaxJar was created to simplify sales tax for eCommerce businesses so compliance is never an issue again.

Get started for free with TaxJar today.