Sales tax guide for online marketplace operators

by February 15, 2025

This guide is for online sellers who have decided to create an online marketplace where multiple sellers can list and sell items. Handling sales tax can be tricky for online marketplace providers, so this guide will help you determine your options and how you should collect sales tax.

The info below is intended to serve as a guide. But, as always, when you have a tricky sales tax situation, we recommend consulting with a sales and use tax expert for specific advice and guidance.

What is an online marketplace?

By the most basic definition, an online marketplace is a website where multiple sellers can list and sell their products.

eBay, Amazon (via FBA or MF) and Etsy are some of the most well-known online marketplaces, but they’re far from the only ones. If you look around you’ll find online marketplaces in all kinds of categories – like 1stDibs for furniture, RubyLane for collectibles, or Ecohabitude for eco-conscious products.

As a buyer, browsing a trusted or curated online marketplace is an easy way to cut through all the noise online and make a purchase. As a seller, selling on an online marketplace is a great way to get your items in front of a group of interested buyers. The marketplace often does a lot of the marketing and advertising heavy lifting so you can focus on selling your products. Everybody wins!

Sales tax 101 for online marketplaces

Most tangible products are taxable in the US and beyond, and that means that as an online marketplace provider, you need to decide how you’ll handle sales tax.

You have a few options:

Option 1: Be the “Seller of Record”

As the “seller of record” on your platform, you are responsible for all sales on your platform. That means you are also responsible for abiding by all sales tax laws and collecting and remitting sales tax. In this case your sellers will love you because you handle the administrative burden of sales tax for them.

But the downside is… you handle the administrative burden of sales tax. You’d have to figure out if you have sales tax nexus in each state (and your sellers would generally create nexus for you), and abide by each state’s sales tax rules and rates. Not to mention, you’d be required tor register for sales tax permits in each state, and to file sales tax returns in multiple states. This can become a tall order very quickly.

While this may sound like a huge hassle, it can be done. t’s up to you to decide how you want to handle sales tax on behalf of your sellers.

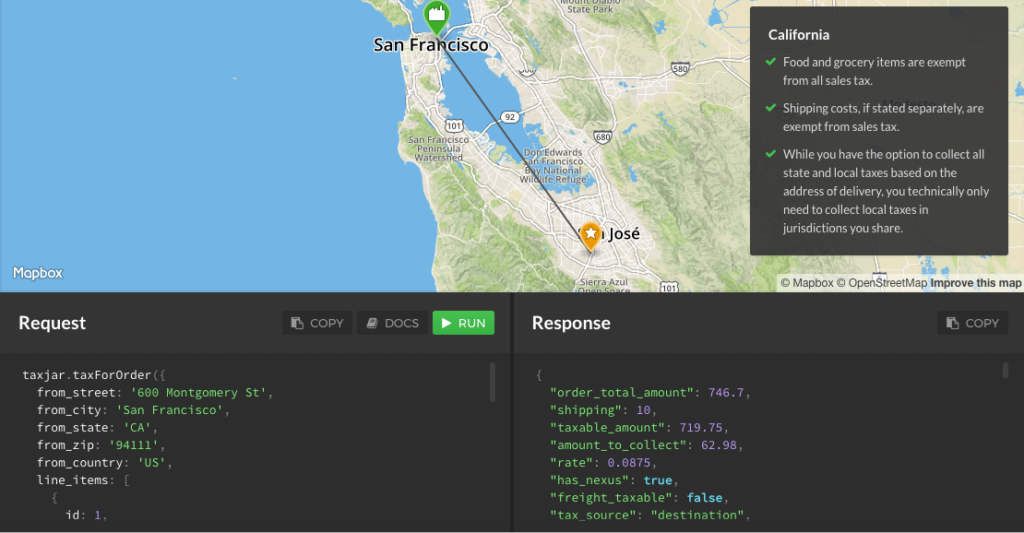

Resource: Find out more about using the TaxJar API to collect sales tax on your online marketplace

Option 2: Provide a way for your marketplace sellers to collect sales tax

Probably the most popular option when dealing with sales tax on marketplaces is to provide your marketplace’s sellers with a way to collect sales tax on their own sales. If you currently sell on a platform like eBay, Amazon or Shopify then you are probably familiar with setting up your tax settings, collecting sales tax from customers and remitting the sales tax you collected to your state (or states) periodically.

If you go this route, you give your sellers a way to calculate and collect sales tax from buyers via your marketplace. The seller is responsible for setting up the sales tax collection settings correctly, registering to collect sales tax, and filing and remitting sales tax when it’s due.

If this is your strategy, you’ll need a sales tax engine to help your customers collect sales tax from their buyers. Skip down to “How to Collect Sales Tax on your Online Marketplace” for how TaxJar’s Sales Tax API can make this simple.

How to collect sales tax on your online marketplace

Whether you’re the seller of record or provide a way for all of your marketplace sellers to collect sales tax, the TaxJar API has your back. With our Sales Tax API, you can act as the seller of record and collect sales tax on all orders transacted on your marketplace, or you can provide your marketplace sellers with a way to collect sales tax on their own orders.

Read our developer’s guide to using the TaxJar API to collect sales tax on online marketplaces here. You can see a demo of how the TaxJar API works here.

Sales tax reporting and filing

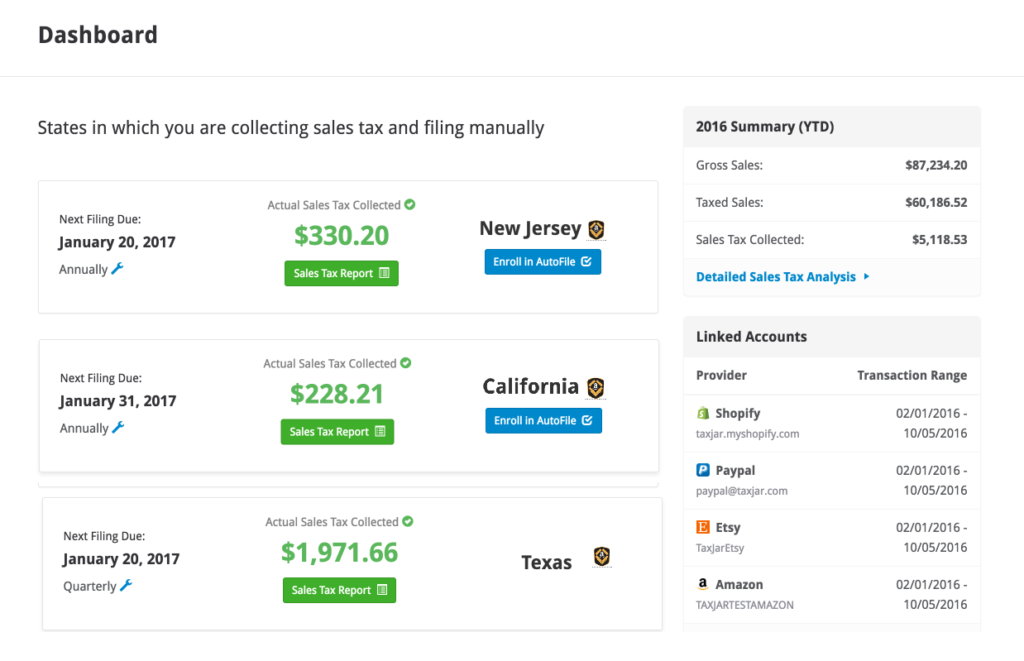

TaxJar also provides sales tax reporting and sales tax filing for online sellers.

If you use the TaxJar API to collect sales tax on your marketplace, your sellers can sign up for a TaxJar account. Their sales tax collected via your marketplace will be automatically imported into TaxJar. We’ll then provide them with return-ready sales tax reports to make it simple to file sales tax in their state (or states.) For busy sellers, we even provide an option to AutoFile sales tax in most states.

Multi-channel support

Most online sellers sell on more than one channel, and TaxJar also directly connects with major channels like Amazon, eBay, Shopify, Magento and many more so that your sellers can see all of their cross-channel sales tax information on one handy dashboard.

How to get started

We built TaxJar to be developer friendly, to save you time and money. Check out our brief guide on how to use the TaxJar API with Marketplaces here. Sign up for a free trial of TaxJar today.