Four reasons why startups should outsource sales tax compliance

by October 7, 2024

There are an average of 4.7 million businesses started each year in the US. This is great news, as startups are responsible for more than 15% of aggregate job creation in the US, explaining why startups are often referred to as the “engine of economic growth.”

However, the startup life isn’t easy, and there is no shortage of work to do. Between creating a solid product, building a customer base, and creating a positive customer support experience, it’s understandable that certain business needs will get pushed to the end of the to-do list. A common example is sales tax compliance. At TaxJar, we often see companies that wait too long to get their compliance in order, and are left paying hefty fines and back taxes.

There is a way to ensure you’re compliant from the beginning while also avoiding spending extra time and resources: outsourcing your sales tax compliance.

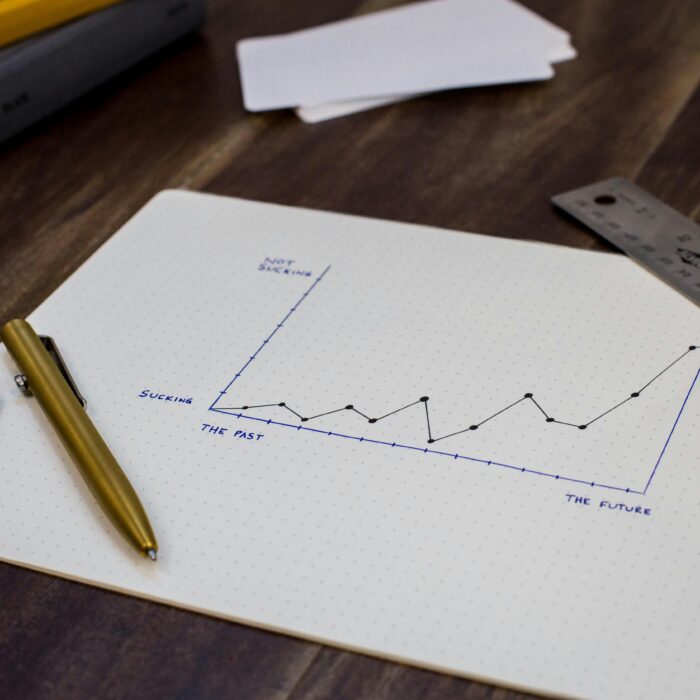

Increase company valuation

If your startup is considering Series A financing or hoping to be acquired by a larger company in the future, you must consider your sales tax compliance strategy. When preparing a pitch deck for investors, finance leaders will not only build financial models and growth projections to forecast the company’s future, they will also showcase the company’s compliance measures across all departments. That means making sure there are audited financials, which can be difficult for a startup, as many early stage companies do not hire a financial lead even after they’ve begun making sales. However, compliance is a big factor for investing companies. If a company acquires a non-compliant company, they will also take on their unpaid sales tax liabilities, like costly fines and penalties.

Outsourcing sales tax compliance management from the beginning is a great step to take to ensure your company can approach these types of growth opportunities knowing sales tax compliance is being properly managed, and non-compliance won’t stand in the way of a high valuation, or acquisition opportunity.

Save time and resources

There is never any shortage of work to be completed at a startup. Often, employees are wearing multiple hats while the company grows and adds more headcount. Sales tax compliance is time consuming, but it’s also not optional if you want to avoid fees and regulatory action. From sales tax registration to filing and remittance, it can take hours each month to ensure you are compliant in each state.

The good news is that sales tax compliance is easily outsourced. It’s a process that benefits from automation, so once you get set up with a sales tax solution, you can spend more time working on revenue-generating activities for your startup. Additionally, you can avoid allocating headcount resources to manage compliance, and can instead focus on hiring to grow your product or service.

Try TaxJar for free

TaxJar offers one platform to manage every aspect of sales tax compliance from calculations to reporting to filing. Try our sales tax compliance platform for 30 days, completely free with no obligation.

Get startedCompliance is easier from the beginning, rather than playing catch up

In the US, retailers are required to collect sales tax from buyers in states where they have “sales tax nexus.” “Nexus” originates from a Latin word meaning “to bind” or “to tie.” If you have sales tax nexus, think of your business as having a “tie” to the state. There are two different types of sales tax nexus, or in other words, two different ways you can meet the requirements to collect and remit sales tax to a state.

Physical nexus is just that, a physical connection to a state. Examples of physical nexus (also sometimes referred to as “physical presence”) include employees, offices, stores, warehouses, conference attendance, servers, etc. Then there is economic nexus. These are either revenue or transaction (or both) thresholds that require businesses who exceed these thresholds to collect sales tax from buyers in that state. For example, in the state of Georgia, businesses only need to collect sales tax from customers if they have exceeded $100,000 in revenue or 200 transactions from customers in Georgia. These thresholds vary from state to state.

Sales tax can be challenging for companies of all sizes, but for a new startup focused on growth, outsourcing sales tax compliance management from the beginning is key. While a startup might begin with only a few sales in one or two states, as the company grows, their compliance obligations grow as well, with the company suddenly having sales tax obligations in 10-20 states.

Outsourcing sales tax compliance to a tool like TaxJar, keeps you compliant as you grow. TaxJar’s nexus insights tracks your sales across all your channels, alerting you when you have met a nexus threshold in a new state. As you grow, you can ensure you are staying compliant.

Be prepared for a sales tax audit

As a startup, you want to spread the news about your company. This could include press releases, marketing activities, and social media posts. While it’s natural to want to get your business some publicity, it can also catch the attention of state sales tax auditors. While there is no one surefire reason a business is selected for an audit, if an auditor sees a new business or a press release that tells a story of unprecedented growth, the state is going to want to see some of that sales tax revenue.

We aren’t suggesting you avoid spreading the word about your business, but outsourced sales tax management can ensure if you are selected for an audit, you are prepared. The more states you make sales in, and the bigger your company revenue gets, it’s more likely you will be selected for a sales tax audit. Rather than scrambling to locate the required tax documentation after the fact, using a sales tax software ensures you have the right information ready if you are selected for a sales tax audit. This can make a stressful audit process much smoother.

TaxJar understands how important accurate sales tax calculations are, which is why we created the TaxJar guarantee. If you are a customer of TaxJar’s API service and a result returned by the service was inaccurate and results in an audit, TaxJar will cover any uncollected sales tax, penalties and interest, resulting from the inaccuracy, up to 2x what you paid TaxJar over the prior 12 months.

How to outsource your sales tax compliance

As a startup focused on growth, you should look for a sales tax compliance solution that can scale with your company. A sales tax solution like TaxJar is a great fit for startups because TaxJar takes care of the entire sales tax life cycle on your behalf, from calculations and nexus tracking to filing and reporting. Since startups might be faced with limited resources, having a solution that can manage the entire process is helpful to keep the amount of resources you have to allocate to sales tax compliance to a minimum.

To learn more about TaxJar and get started automating your sales tax compliance, start a free, 30-day trial today.