What you need to know about the pink and tampon tax

by January 2, 2025

You might have heard people talking more over the last two years, on the subject of the “pink tax.” But what is it and what does it have to do with the tampon tax? Are they the same thing or something completely different? And what do I need to know when it comes to sales tax? If you’re a grocery business, women’s subscription service or e-commerce seller (like LOLA, Cora or Thinx) – this impacts you and your customers.

What is the pink tax?

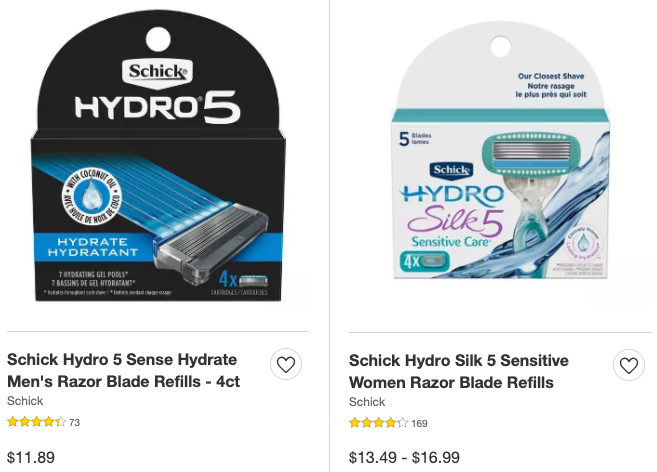

The pink tax is the extra amount that women pay for everyday items such as razors, shampoo, haircuts, clothes, dry cleaning, etc. This is sometimes, but not always, a literal (sales) tax. More often than not, it takes the form of artificially elevated prices that women pay for the same product as men.

Also, packaging and/or the product itself is usually pink, hence the pink tax moniker.

Why are tampons taxed?

One controversial part of the pink tax is known as the tampon tax. This is a regular sales tax that’s applied to an item in a category generally considered “non-luxury necessities,” which are typically exempt from sales tax. Why is it controversial? Almost all U.S. states exempt non-luxury necessities such as groceries or prescriptions from sales tax, and yet almost all states charge tax on menstrual products, including pads and cups – despite that these items are considered a necessity by most women. To make it clear, women’s menstrual products are considered luxury necessities and are taxed as such.

What’s happening with the tampon sales tax?

The result is an organized push (Period Equity; Tax Free Period) to repeal the tampon tax, to change the law to treat these products like groceries and medical supplies – that they are necessities and should be tax-exempt. Lawmakers in many states are advocating to eliminate the tampon tax. Fourteen states and Washington, DC have succeeded so far – Connecticut, Florida, Illinois, Maryland, Massachusetts, Michigan, Minnesota, Nevada, New Jersey, New York, Pennsylvania, Rhode Island, Utah, and Ohio.

States are continuing to repeal tampon taxes in 2022. On February 3, 2022, Michigan Gov. Gretchen Whitmer signed into law that Michigan will not apply a 6% sales tax to menstrual products.

Which states have a tampon tax?

States that tax menstrual products

Alabama: Currently taxes menstrual products

Arizona: Currently taxes menstrual products

Arkansas: Currently taxes menstrual products

Georgia: Currently taxes menstrual products

Hawaii: Currently taxes menstrual products

Idaho: Currently taxes menstrual products

Indiana: Currently taxes menstrual products

Kansas: Currently taxes menstrual products

Kentucky: Currently taxes menstrual products

Mississippi: Currently taxes menstrual products

Missouri: Currently taxes menstrual products

North Carolina: Currently taxes menstrual products

North Dakota: Currently taxes menstrual products

Oklahoma: Currently taxes menstrual products

South Carolina: Currently taxes menstrual products

Tennessee: Currently taxes menstrual products

Utah: Currently taxes menstrual products, after many appeals (Source)

West Virginia: Currently taxes menstrual products

Wisconsin: Currently taxes menstrual products

Wyoming: Currently taxes menstrual products

States that don’t tax menstrual products

Alaska: Doesn’t have a state-wide sales tax. Menstrual products are tax-free.

California: Temporarily tax-free through 2022

Colorado: Beginning January 1, 2023, Colorado will exempt feminine hygiene products from sales tax. (Source)

Connecticut: Eliminated the tax in 2016

Delaware: Doesn’t have sales tax. Menstrual products are tax-free.

Florida: Eliminated the tax in 2018

Illinois: Eliminated the tax in 2016

Iowa: Beginning January 1, 2023, Iowa will exempt feminine hygiene products from sales tax.

Louisiana: Eliminated the tax in 2021 — goes into effect on July 1, 2022.

Maine: Eliminated the tax in 2019 (Source)

Maryland: State sales tax exemption includes feminine hygiene products (considered medical products)

Massachusetts: State sales tax exemption includes feminine hygiene products (considered medical products)

Michigan: Eliminated the tax in 2022

Minnesota: State sales tax exemption includes feminine hygiene products

Montana: Doesn’t have sales tax. Menstrual products are tax-free.

Nebraska: Exempts menstrual products as of October 1, 2022

Nevada: Eliminated the tax in 2018

New Hampshire: Doesn’t have sales tax. Menstrual products are tax-free.

New Jersey: State sales tax exemption includes feminine hygiene products

New Mexico: Eliminated the tax in 2021 (Source)

New York: Eliminated the tax in 2016

Ohio: Eliminated the tax in 2019

Oregon: Doesn’t have sales tax. Menstrual products are tax-free.

Pennsylvania: State sales tax exemption includes feminine hygiene products

Rhode Island: Eliminated the tax in 2019

Texas: Eliminated the tax in 2023

Vermont: Eliminated the tax in 2021 (Source)

Virginia: Eliminated the tax in 2023 (Source)

Washington: Eliminated the tax in 2020 (Source)

Washington, DC: Eliminated the tax in 2016

Ready to automate sales tax? Sign up for a free trial of TaxJar today.