TaxJar sales tax reports vs. Amazon sales tax reports

by November 27, 2023

Please note: This blog was originally published in 2019. It’s since been updated for accuracy and comprehensiveness.

TaxJar didn’t always help FBA sellers report and file sales tax. But when we first started solving the problem of e-commerce sales tax, customers kept asking one thing of us: “Help us with the Amazon sales tax report!”

So we took a look at a few sample sales tax reports from Amazon and came to the same conclusion these early customers did: Amazon’s sales tax report is gnarly.

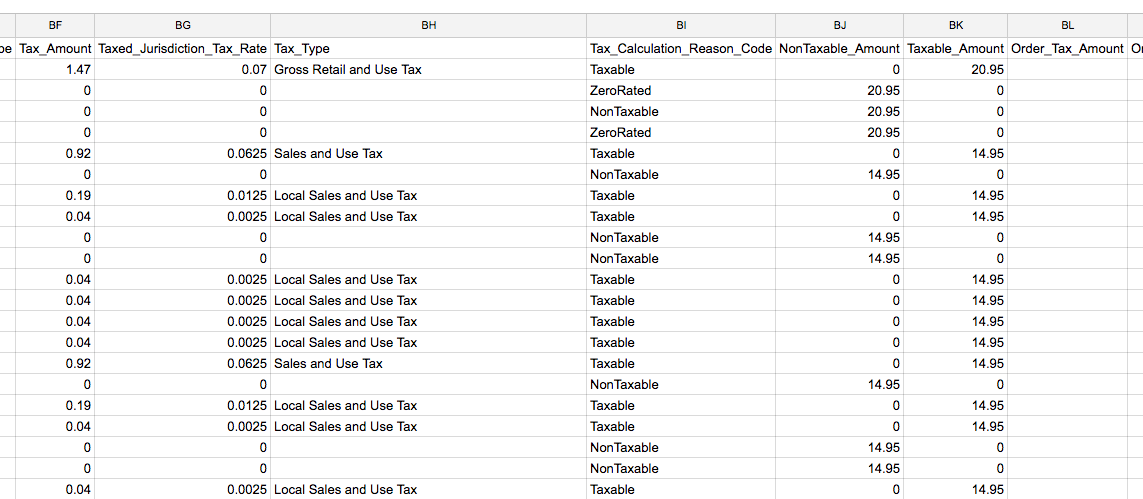

Here’s a sample Amazon sales tax report so you can see for yourself. Notice that this spreadsheet doesn’t even get into the nitty gritty of sales tax until column BF. (This report was shared with us by a real Amazon seller, so please note that parts of the report have been redacted to protect that seller’s privacy and competitive information.)

TaxJar’s state sales tax reports take all of this jumbled information and magically transform them into return-ready reports for each state.

Let’s dig a little deeper:

Amazon report vs. TaxJar: Showing sales tax collected

Amazon: Spend hours deciphering sales tax reports

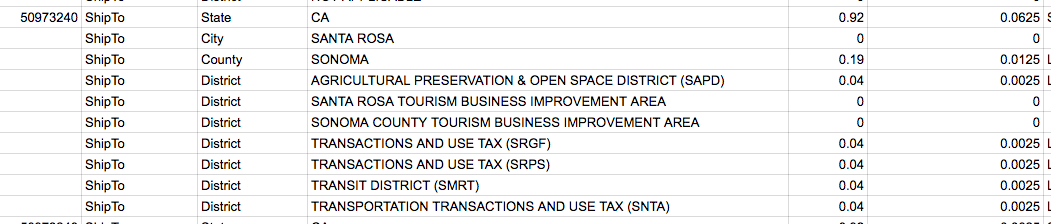

The Amazon report shows sales tax collected transaction by transaction. Further, it breaks down transactions in each state by state and local jurisdiction. This means that each transaction takes up at least three rows on the spreadsheet, though some take up many more. For example, here’s a sale to Santa Rosa, California.

This shows the sales tax collected in 7 out of 10 possible taxing jurisdictions. And this is just one transaction. Keep in mind this report is from a seller who uses TaxJar’s Basic plan and it includes over 3,000 rows.

If you were to try and report how much Amazon sales tax you collected yourself, using this report, you’d need to do the following:

1.) Find every instance where you charged sales tax to a buyer in each of these locations (California, Sonoma County, the Santa Rosa Tourism and Business Improvement Area, SRGF tax, etc.)

2.) Figure out where to enter those numbers on the California sales tax filing.

3.) Make sure those figures add up identically to the state’s sales tax filing form.

4.) Oh and don’t forget to make sure you’re dealing with the correct dates! (Need to know what date the sale was made on? That’s way back over in columns B, D, E and F. TaxJar makes this simple by always using Column B “order date.”)

Because Amazon’s reports are so complex, you can’t simply sort them by row or column. This requires advanced spreadsheet knowledge like pivot tables… and hours of your valuable time.

TaxJar: Your sales tax handled in minutes

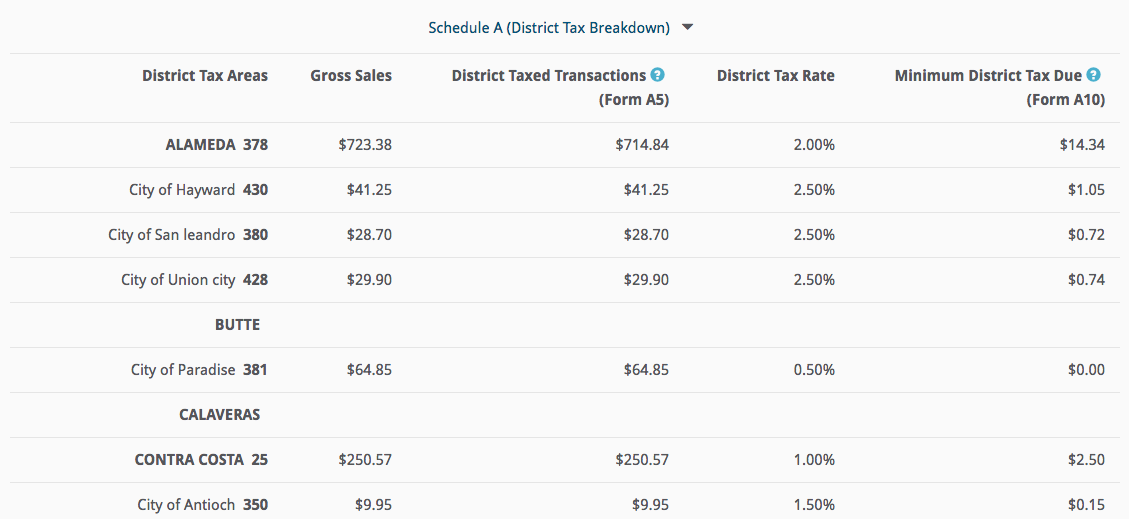

In contrast to the Amazon spreadsheet, TaxJar connects with your Amazon account just one time and from there compiles all this information for you into a return-ready report.

Here’s an example of the information TaxJar will give you to fill out your California sales tax returns, including Schedule A and Schedule B:

TaxJar automatically shows you:

1.) How much you collected in each state, county, city and special taxing district

2.) The exact information you need to fill out your sales tax filings

Depending on transaction volume, TaxJar customers typically take between 5-10 minutes to fill out a sales tax return.

Check it out for yourself on a TaxJar state report.

Amazon reports vs. TaxJar: Expected sales tax due

Amazon provides little to no sales tax guidance

Amazon provides extremely limited guidance to sellers who are unsure about how to collect sales tax. They are very clear to state in their Terms of Use that collecting and filing sales tax is up to the individual seller. Amazon provides sellers with a tax table showing all US states and then relies on you to figure out how to fill out that table.

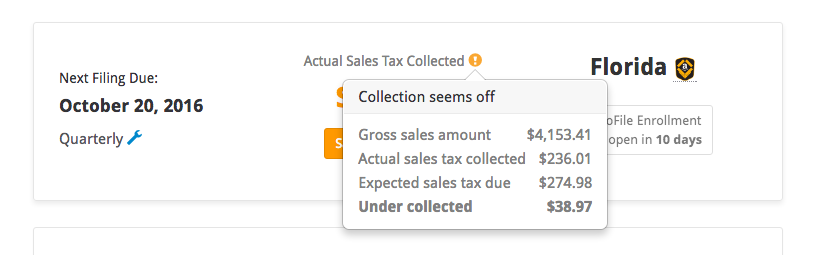

TaxJar’s built-in features ensure you’re collecting the right amount of sales Ttx

In contrast, TaxJar’s Expected Sales Tax Due Reports show you where we suspect you may have set up sales tax collection incorrectly.

Summary

Amazon is a wonderful platform for growing and scaling your e-commerce business, but it isn’t easy to use Amazon’s built-in report to file and pay your Amazon FBA sales tax.

TaxJar works with your Amazon seller account to alleviate your sales tax headaches so you can get back to focusing on the more profitable aspects of your business.

Ready to automate sales tax? Sign up for a free trial of TaxJar today.