Is shipping in Indiana taxable?

by October 20, 2023

Please note: This blog was originally published in 2014. It’s since been updated for accuracy and comprehensiveness.

You’ve just sold some items through your online store in the state of Indiana. While you know you have sales tax nexus there and need to charge sales tax on the products you’ve sold, you’re not sure if the charges you add on for shipping and handling are taxable.

To help you out, we took a look at state regulations regarding collecting sales tax on shipping in Indiana. While it’s mostly straightforward, there are a few things that separate it from other states. Make sure to take these differences into consideration to comply with local laws.

Sales tax on shipping in Indiana has changed

If you sold items in Indiana before July 1, 2013, you were likely required to charge sales tax on almost all shipping charges. As a result you may think the rules still dictate sales tax is included on transportation, handling, and other shipping costs.

However, on July 1, 2013, some things changed. New rules say that transportation, shipping, crating, handling, packing and postage charges that are separately stated on the invoice are NOT taxable in some circumstances (keep reading!). Charges that are not separately stated on the invoice are, however, still taxable.

Also, if you deliver your goods via the USPS then delivery charges are not taxable. But if you use a private carrier like FedEx, UPS, etc. then shipping charges are taxable. Confused yet?

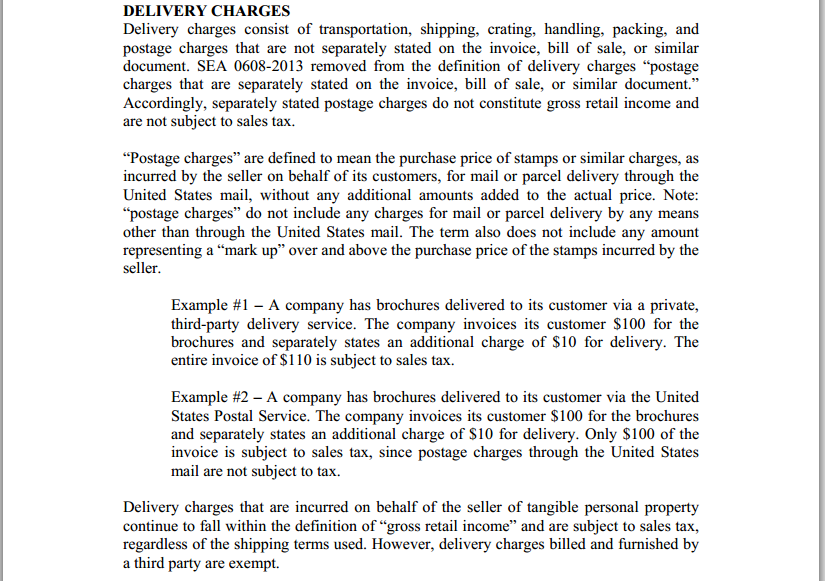

Here’s what the Indiana Department of Revenue has to say:

Basically, if you use the US mail service to ship your items, you should be fine as long as you state the shipping charges separately on the invoice. If you use a third party service, which includes UPS, FedEx, etc. or delivered items yourself, you are most likely required to charge sales tax on shipping charges. Also if you don’t separately state the charges on the invoice, you’re going to have to collect and remit sales tax to the state.

Ready to automate sales tax? To learn more about TaxJar and get started, visit TaxJar.com/how-it-works.