Is shipping taxable in Minnesota?

by January 16, 2024

Please note: This blog was originally published in 2015. It’s since been updated for accuracy and comprehensiveness.

It’s probably not possible for sales tax to be a bigger headache for eCommerce sellers, but the states do give it their best shot. Especially by drafting their own rules of when and how it is applied. Let’s take a look at how Minnesota handles sales on shipping and handling.

Is Shipping Taxable in Minnesota?

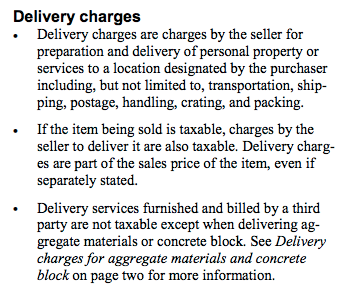

The Minnesota Department of Revenue has this to say:

Thankfully, Minnesota makes it pretty easy for sellers to know whether to charge sales tax on shipping and handling. If you are shipping a taxable item, the shipping and handling is taxable, even if separately stated on the invoice.

If you are shipping a non-taxable item like a grocery item, then the shipping is not taxable. If a third party carrier furnishes delivery service and charges for the service, then it is not taxable.

In summary:

You will most likely charge sales tax on shipping in Minnesota.

If you are selling an item that is taxable and you ship it, the shipping and handling is taxable. The only way it ISN’T taxable is:

- You are shipping non-taxable items like food.

- A third party carrier handles the delivery and charges for the delivery.

Other than that, you are going to have to pay sales tax on shipping and handling.

Ready to automate sales tax? To learn more about TaxJar and get started, visit TaxJar.com/how-it-works.