Easily manage the complexities of sales tax on SaaS and digital goods

Keeping pace with the new digital economy means ever-changing taxability. Reduce the complexity of compliance with automation.

Keeping pace with the new digital economy means ever-changing taxability. Reduce the complexity of compliance with automation.

Is an online training course taxable? What about streaming content? Some states consider Software-as-a-Service (SaaS) and digital goods to be taxable products, and others consider them non-taxable services.

We’re a SaaS company ourselves, so we know how challenging it can be to track sales tax rules and rates across jurisdictions. That’s why we built our automation platform to make it as easy as possible for modern cloud services like ours to stay on top of the complexities.

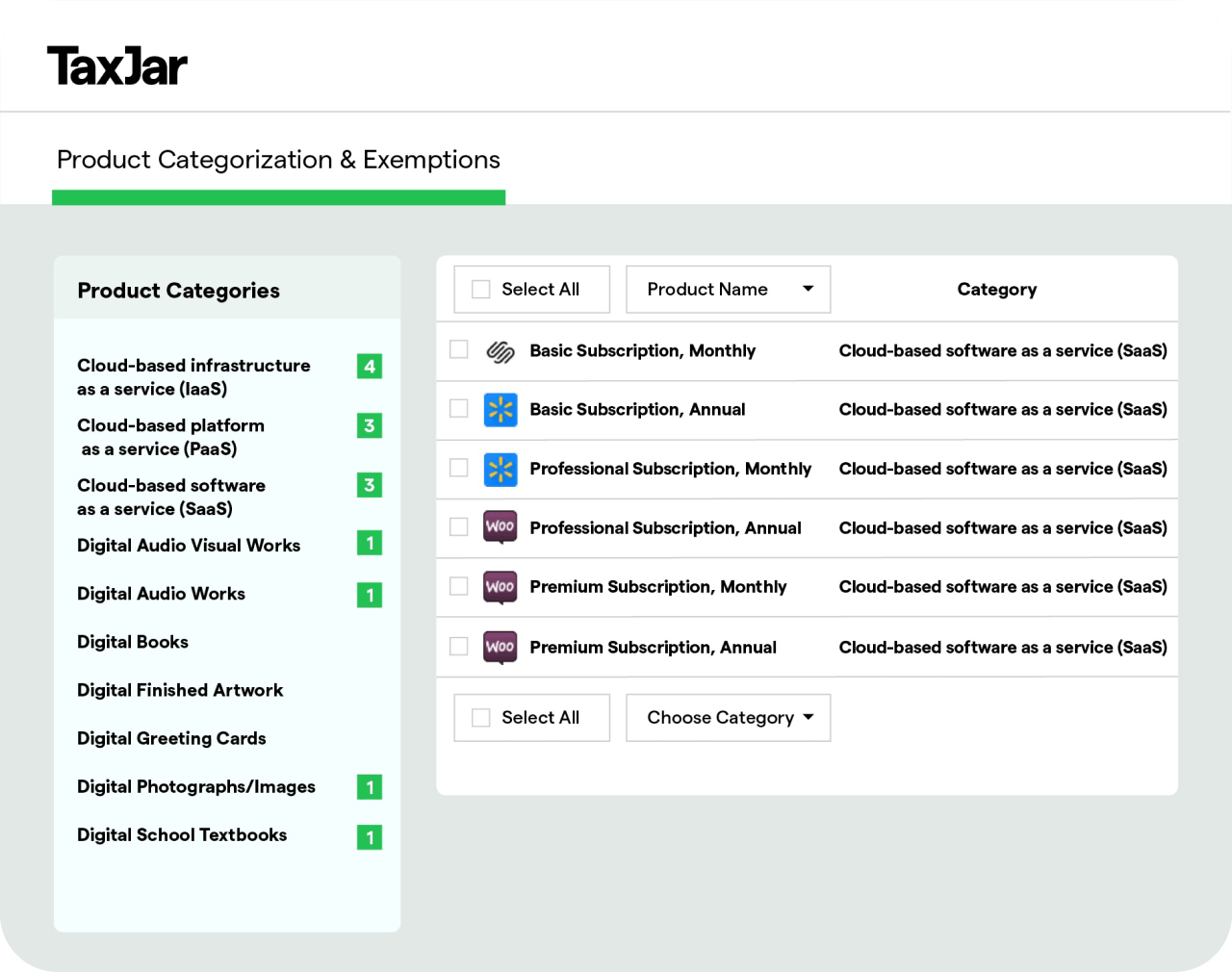

Smart product classification tools

The TaxJar API lets you assign a product tax code to all of your digital offerings, so you always know which ones require sales tax.

Rates based on addresses, not zip codes

Our API and calculation engine apply rooftop-accurate rates based on your customer’s state, county, city, and even district.

Continuous tax law monitoring

Our in-house team of sales tax researchers are constantly reviewing the ever-changing tax codes that impact SaaS companies.

Learn more about the TaxJar API

As your company grows, there should be no hiccups with collecting sales tax when customers buy your digital goods or upgrade your SaaS products. TaxJar is designed to scale with your business, giving you a seamless path to growth.

Reliability and speed

The TaxJar API clocks in at sub-25ms with 99.99% uptime, giving your customers instant, accurate tax data at checkout.

Tax liability tracking & alerts

Our Economic Nexus Insights dashboard alerts you when you’re approaching a nexus threshold in a new state.

Effortless filing across multiple states

TaxJar AutoFile automatically submits your return to multiple states with different requirements — accurately and on time.

More on reliability and availabilityThe global e-commerce market reached $3.5 trillion in sales for 2019.

Yet, there was a tax gap of $400 billion between taxes owed and taxes collected (IRS estimate).

*Source: IDC Market Spotlight: Uncertainty and Complexity Drive Sales and Use Tax Transformation, October 2020. Download the report

TaxJar integrates with the providers that manage your digital payments infrastructure and subscription services. Our team maintains a curated set of prebuilt integrations with popular platforms like Stripe and Chargebee. You can get set up in minutes directly from the TaxJar dashboard or use the TaxJar API to customize your integration.

Tested and certified integrations

TaxJar integrations are built in-house and by our partners. Our team rigorously tests each one against the highest standards.

Customization options with the TaxJar API

If your needs go beyond our prebuilt solutions, the TaxJar API lets you build your own custom solution.

See the full list of TaxJar integrationsTaxJar simplifies sales tax compliance every step of the way. Here’s how our platform works:

Prebuilt integrations with popular platforms quickly connect TaxJar to your existing systems.

Our Nexus Insights Dashboard and notifications help you stay ahead of your sales tax responsibilities by state.

Our real-time calculation engine and sales tax API provides rooftop-level, product-specific sales tax.

Our reporting dashboard compiles data from all your channels to give you the most up-to-date view of your transactions and tax liability.

TaxJar AutoFile prepares and submits an accurate return and remittance for each state in which you’re enrolled.